Introduction

Introduction

Banking Awareness is an important section in the employment-related competitive exams in India. In particular, exams like IBPS, RBI Grade B, SBI PO, RRB and other banking examinations. This article Banking Awareness Quiz – 8 presents the model questions related to some Banking Awareness topics useful to the candidates preparing all Bank exams.

Q1

Q1

Reserve Bank of India has provided no objection to ____ for the proposed acquisition of Gruh Finance.

- A. Lakshmi Vilas Bank

B. Bandhan Bank

C. IDFC Bank

D. Kotak Mahindra Bank

Reserve Bank of India provided no objection to Bandhan Bank for the proposed acquisition of Gruh Finance. Gruh Finance Limited is an Ahmedabad headquartered Subsidiary of HDFC Limited.

Q2

Q2

Which of the following Bank has signed a pact with the Bank of China to boost business opportunities recently?

- A. ICICI Bank

B. IDFC Bank

C. State Bank of India

D. HDFC Bank

The country’s largest lender State Bank of India has signed a pact with the Bank of China to boost business opportunities. SBI has signed an MoU to enhance business synergies between both the banks.

Q3

Q3

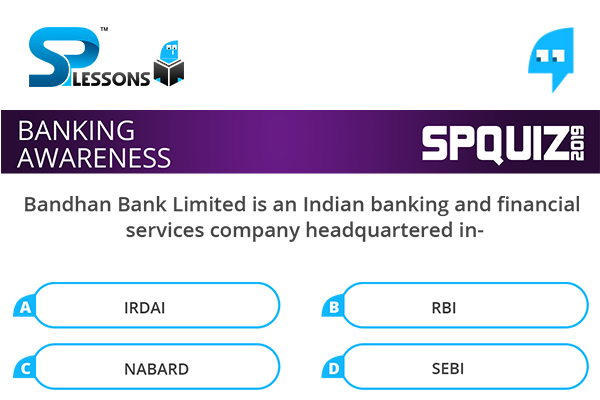

Bandhan Bank Limited is an Indian banking and financial services company headquartered in-

- A. IRDAI

B. RBI

C. NABARD

D. SEBI

The Reserve Bank set the average base rate to be charged from borrowers by non-banking financial companies (NBFCs) and micro-finance institutions (MFIs) at 9.21% for the first quarter of the next fiscal (April-June). The regulator in February 2014 had issued directions to NBFC-MFIs regarding pricing of credit.

Q4

Q4

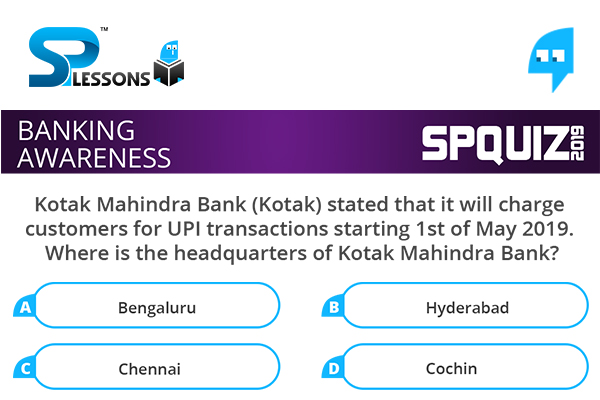

Kotak Mahindra Bank (Kotak) stated that it will charge customers for UPI transactions starting 1st of May 2019. Where is the headquarters of Kotak Mahindra Bank?

- A. Bengaluru

B. Hyderabad

C. Chennai

D. Cochin

Kotak Mahindra Bank (Kotak) stated that it will charge customers for UPI transactions starting 1st of May 2019. For each Kotak Bank account, the first 30 UPI fund transfers will be free, after which a charge will be levied on all fund transfers from the bank account.

Q5

Q5

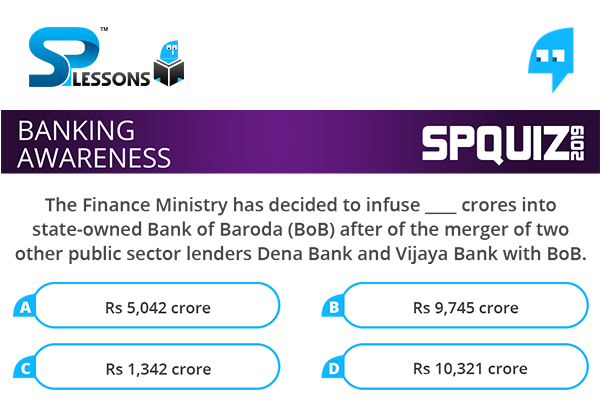

The Finance Ministry has decided to infuse ____ crores into state-owned Bank of Baroda (BoB) after of the merger of two other public sector lenders Dena Bank and Vijaya Bank with BoB.

- A. Rs 5,042 crore

B. Rs 9,745 crore

C. Rs 1,342 crore

D. Rs 10,321 crore

The Finance Ministry has decided to infuse Rs 5,042 crore into state-owned Bank of Baroda (BoB) after the merger of two other public sector lenders Dena Bank and Vijaya Bank with BoB.