Introduction

Introduction

Banking Awareness is an important section in the employment-related competitive exams in India. In particular, exams like IBPS, RBI Grade B, SBI PO, RRB and other banking examinations. This article Banking Awareness Quiz 20 presents the model questions related to some Banking Awareness topics useful to the candidates preparing all Bank exams.

Q1

Q1

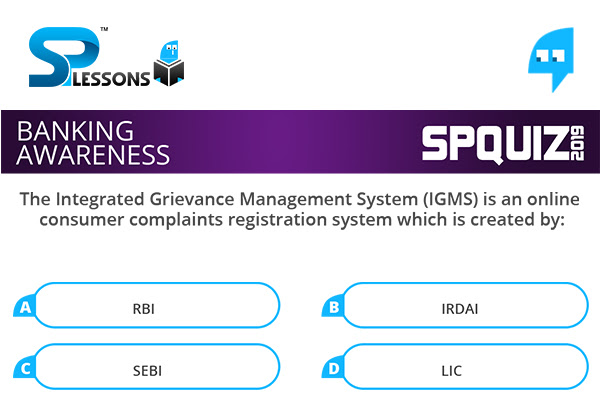

The Integrated Grievance Management System (IGMS) is an online consumer complaints registration system which is created by:

- A. RBI

B. IRDAI

C. SEBI

D. LIC

• The Integrated Grievance Management System (IGMS) facilitates online registration of policyholders’ complaints and helps track their status. It is created by the Insurance Regulatory and Development Authority (IRDA).

• Policyholders can register their complaints online with their insurance company and track the progress of complaint resolution. IRDA monitors the complaints and their progress in real-time through IGMS.

Q2

Q2

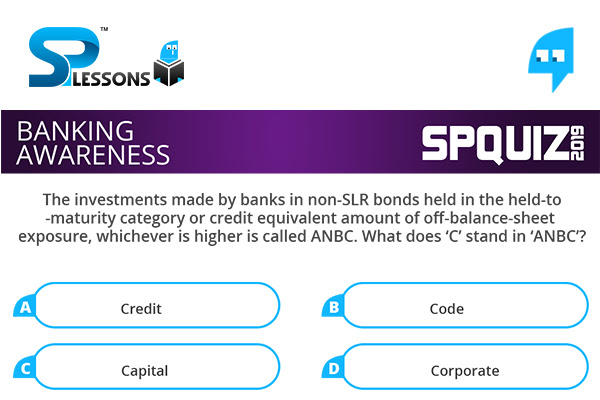

The investments made by banks in non-SLR bonds held in the held-to-maturity category or credit equivalent amount of off-balance-sheet exposure, whichever is higher is called ANBC. What does ‘C’ stand in 'ANBC’?

- A. Credit

B. Code

C. Capital

D. Corporate

ANBC is investments made by banks in non-SLR bonds held in the held-to-maturity category or credit equivalent amount of off-balance-sheet exposure, whichever is higher. Here, ANBC stands for Adjusted Net Bank Credit. So, C stands for Credit.

Q3

Q3

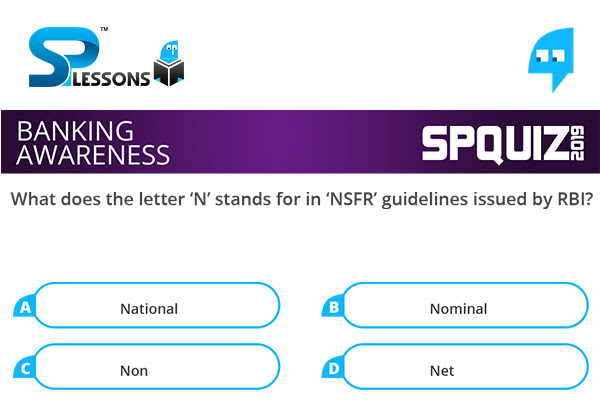

What does the letter 'N' stands for in 'NSFR' guidelines issued by RBI?

- A. National

B. Nominal

C. Non

D. Net

NSFR stands for - Net Stable Funding Ratio

* It is defined as the amount of available stable funding (ASF) relative to the amount of required stable funding (RSF).

* It promotes resilience over a longer-term time horizon by requiring banks to fund their activities with more stable sources of funding on an ongoing basis.

* The above ratio should be equal to at least 100 percent on an ongoing basis.

Q4

Q4

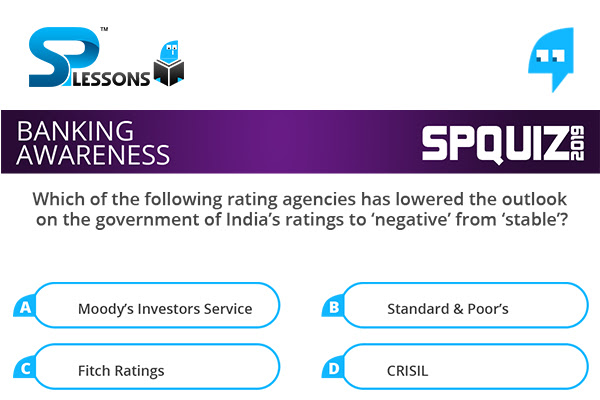

Which of the following rating agencies has lowered the outlook on the government of India's ratings to ‘negative’ from ‘stable’?

- A. Moody’s Investors Service

B. Standard & Poor's

C. Fitch Ratings

D. CRISIL

* Global rating agency Moody’s Investors Service ("Moody's") has lowered the outlook on the government of India's ratings to ‘negative’ from ‘stable’.

* It affirmed the Baa2 foreign-currency and local-currency long-term issuer ratings for India.

* Moody's also affirmed India's local-currency senior unsecured rating and another short-term local-currency rating.

* India’s economy grew only 5.0% year-on-year between April and June, its weakest pace since 2013.

Q5

Q5

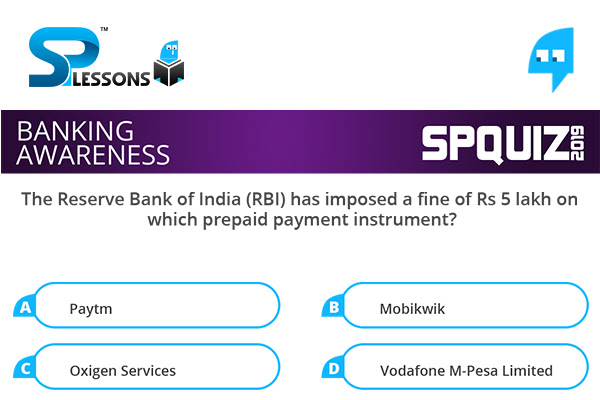

The Reserve Bank of India (RBI) has imposed a fine of Rs 5 lakh on which prepaid payment instrument?

- A. Paytm

B. Mobikwik

C. Oxigen Services

D. Vodafone M-Pesa Limited

* The Reserve Bank of India (RBI) has imposed a fine of Rs 5 lakh on prepaid payment instrument Oxigen Services.

* The move was taken in exercise of powers vested under Section 30 of the Payment and Settlement Systems Act, 2007, for non-compliance of regulatory guidelines.

* The fine comes through a speaking order dated September 17, 2019.

* Oxigen Services facilitates payment processing and money transfer services.