Introduction

Introduction

Banking Awareness is an important section in the employment-related competitive exams in India. In particular, exams like IBPS, RBI Grade B, SBI PO, RRB and other banking examinations. This article Banking Awareness Quiz 19 presents the model questions related to some Banking Awareness topics useful to the candidates preparing all Bank exams.

Q1

Q1

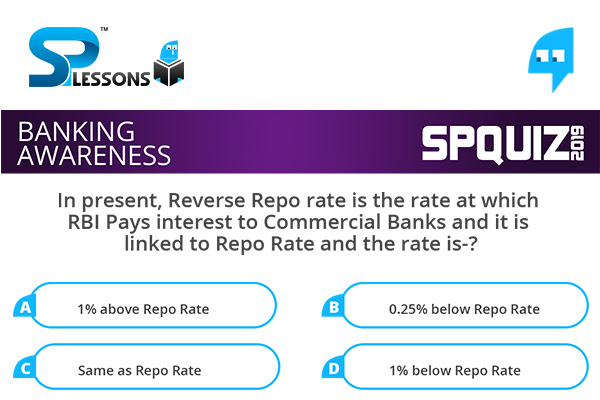

In present, Reverse Repo rate is the rate at which RBI Pays interest to Commercial Banks and it is linked to Repo Rate and the rate is-?

- A. 1% above Repo Rate

B. 0.25% below Repo Rate

C. Same as Repo Rate

D. 1% below Repo Rate

Policy Repo Rate: 5.40% and Reverse Repo Rate: 5.15%.

Q2

Q2

Banks in our country normally publicize that additional interest rate is allowed on retail domestic term deposits of________.

- A. Minors

B. Married women

C. Senior citizens

D. Govt. employees

Banks in our country normally publicize that additional interest rate is allowed on retail domestic term deposits of senior citizens.

Q3

Q3

Which of the following is NOT a function of the Reserve Bank of India?

- A. Fiscal Policy Functions

B. Exchange Control Functions

C. Monetary Authority Functions

D. Supervisory and Control Functions

Fiscal policy is the means by which a government adjusts its spending levels and tax rates to monitor and influence a nation’s economy. It is the sister strategy to monetary policy through which a central bank influences a nation’s money supply.

Q4

Q4

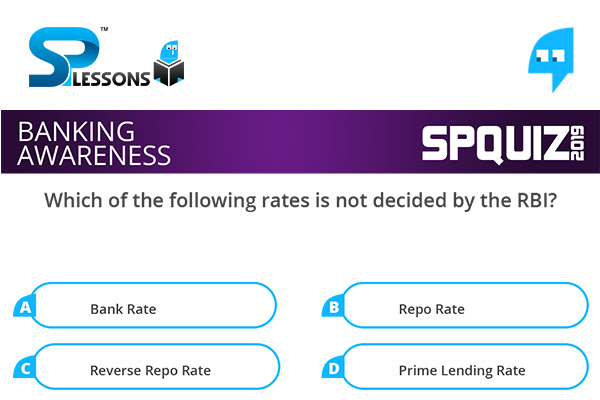

Which of the following rates is not decided by the RBI?

- A. Bank Rate

B. Repo Rate

C. Reverse Repo Rate

D. Prime Lending Rate

Historically, prime lending rate is the interest rate at which banks lend to its most credit worthy customers. But, over the course of history, banks have come to lend to customers at interest rates below and above the prime lending rate. Prime lending rate of banks do not vary widely.

Q5

Q5

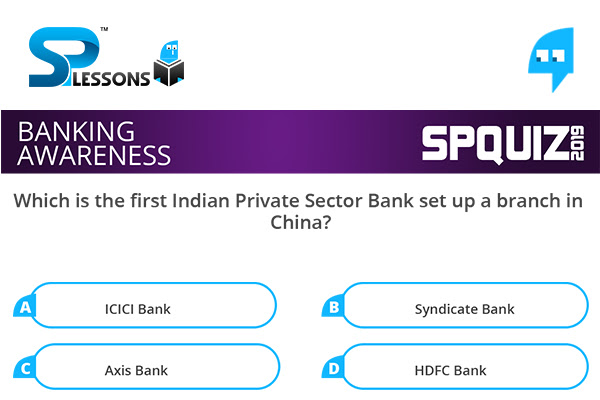

Which is the first Indian Private Sector Bank set up a branch in China?

- A. ICICI Bank

B. Syndicate Bank

C. Axis Bank

D. HDFC Bank

Axis Bank, the First Indian Private Sector Bank to Set up a Branch in China.