Introduction

Introduction

Choosing a career option is the most crucial task that every person goes through in his life at some point of time or another. With so many various options available, one tends to get confused as to which option to go for. Many times even getting counseling from the experts does not help the candidates in realizing their area of interest which they would like to pursue as their career option.

Many students try their luck in government sector because of the satisfied salary, perquisites and benefits and job security and the scope for promotion and transfers. These are some factors that attract the candidates towards choosing the government job over any private sector job.

Many candidates prefer appearing for IBPS Clerical and IBPS PO exams as their career option. These are government job and provided job security to the employees.

Many a times the candidates get confused between the IBPS Clerk post and IBPS PO post. Following are the primary differences between the two IBPS career options.

| Point of Difference | IBPS Clerk | IBPS PO |

|---|---|---|

| Job Profile | Clerk is the first person who comes in contact with the customers and guides them with different problems. | The candidate of this post is required to have knowledge about various departments like Marketing, Finance, Loans, Accounting and Advances. |

| Responsibilities | The candidate manages withdrawing and depositing the cash of the customers. The candidate issues ESI stamps and the receipts of the cash, ledger balance, data entry and also issues cheque book. The candidate is also required to maintain daily transactions and other information useful to the customers. | The candidate guides the customer regarding new products and services which are introduced by the bank. The candidate also issues cheques, ATM cards, and Demand drafts. Bringing business to the bank and supervising the transactions of the customers is also the duty which a PO has to fulfill. |

| Salary | The salary of a clerk starts from RS. 11000 and goes up to Rs. 42000. | The salary of the PO starts from Rs. 23000 and it depends upon the location where the candidate has been posted. |

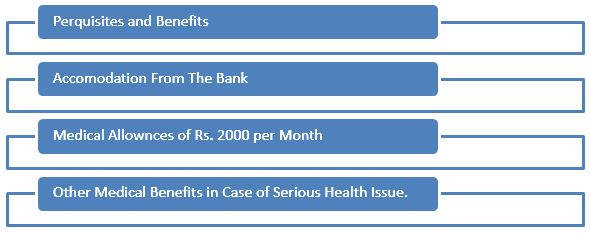

| Perquisites and Benefits | The perquisites offered to the clerks are house rent allowance, dearness allowance and some medical allowance as well. | The perquisites which are provided to the Po are special allowance, dearness allowance, house rent allowance, travel allowance, travel allowance, city compensatory allowance, leased accommodation and medical benefits. Pension scheme is also provided to the Po candidates. |

| Procedure for Selection | For clearing the test of the clerical post, there are three steps. First is the prelim for 100 marks and includes aptitude, English and reasoning. The main exam is of 200 marks and is held for 135 minutes and includes reasoning, computer, general knowledge, English and the knowledge regarding the computer. Final step is the interview for clearing the test. | There are three steps that are held for the selection of candidates for the post of PO. The prelims exams are the first step which is a test of 100 marks and includes aptitude, English and reasoning. The main exam is of 200 marks and includes reasoning, computer, general knowledge, English and Data analysis and interpretation. And the final step is the interview. |

IBPS Clerk

IBPS Clerk

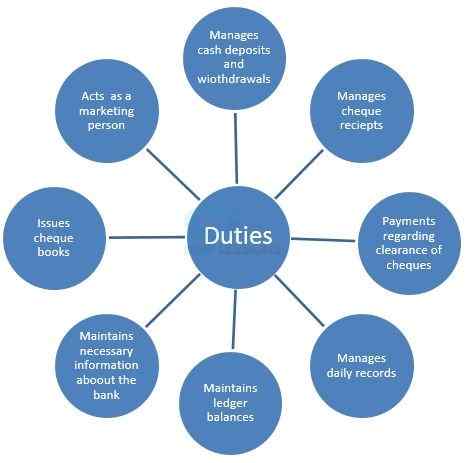

IBPS Clerk Duties

The duties of a clerk are related in managing the accounts and daily office tasks in the bank. Following are some duties that are performed by the clerk in a bank.

- ✶ The clerk handles cash deposits and cash withdrawals done by the customer.

✶ The clerk takes the charge of the cheque receipts, drafts, dividend warrants and pay orders.

✶ The clerk has to make sure of the payments regarding the clearance of the cash.

✶ The clerk has to maintain the balance of daily record.

✶ The clerk has to maintain ledger balance, tally, data entry and ESI stamps.

✶ The clerk has to maintain a record of necessary information regarding the bank.

✶ The clerk also issues the cheque books to the customers.

✶ The clerk acts as a marketing person to market the policies regarding the bank loans, mutual fund policy, deposits and various other schemes.

- ✶ Sublet property from the bank who recruits the candidate.

✶ Medical allowances which are Rs. 2000 per month.

✶ In case of other serious health issues, the candidate will get other medical benefits as well.

IBPS PO

IBPS PO

IBPS PO Duties

The post of a PO is one of the important posts and active profile in any bank. It is considered to be a profitable career choice and an official job. There growth and development under this career option is humungous. It makes the future of the candidate bright and secured.

Roles of a PO

There are different roles which a PO is required to fulfill in a bank. They are as follows.

- ✶ The officer is required to multi task regarding many departments.

✶ The officer also manages customer services and satisfaction.

✶ The PO has to manage with the customers and their problems.

✶ Getting the loan processed is also the role of a PO.

✶ The PO conducts official meetings with the employees.

✶ Maintaining public relations is also the duty of the PO.

✶ The PO also has to handle customer complaints regarding the different issues and the services which are provided by the bank.

✶ The PO has to rectify the excessive charges.

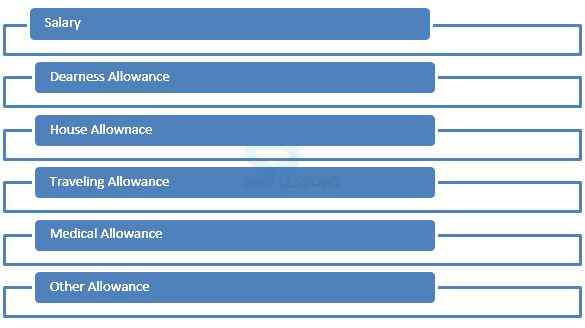

- ✶ Salary:

The salary which is paid in the government sector is relatively good for any person.

✶ House Rent Allowance:

When people are transferred from one place to another, the major problem faced by people is of housing. For this purpose, the bank offers the PO with housing facility amking it convenient for him to stay at a different place.

✶ Dearness allowance:

The DA provided to the PO of a bank makes to more desirable post by the candidates.

✶ Other allowance:

Under the category of other allowance includes newspaper expenses, petrol expenses up to 35 liters. Some banks also give the benefit of telephone and entertainment allowances.