Introduction

Introduction

The Reserve Bank of India was established on April 1, 1935 in accordance with the provisions of the Reserve Bank of India Act, 1934 (recommendations of John Hilton Young Commission 1926 – called Royal Commission on Indian Currency & Finance).

-

- The Central Office of the Reserve Bank was initially established in Calcutta but was permanently moved to Mumbai in 1937.

-

- The Central Office is where the Governor sits and where policies are formulated. Though originally privately owned, since nationalization in 1949, the Reserve Bank is fully owned by the Government of India.

-

- RBI is not expected to perform the function of accepting deposits from the general public.

-

- RBI has its headquarters at Mumbai.

-

- RBI decides the following rates namely; Bank rate, repo rate, reverse repo rate & cash reserve ratio.

Organization

Organization

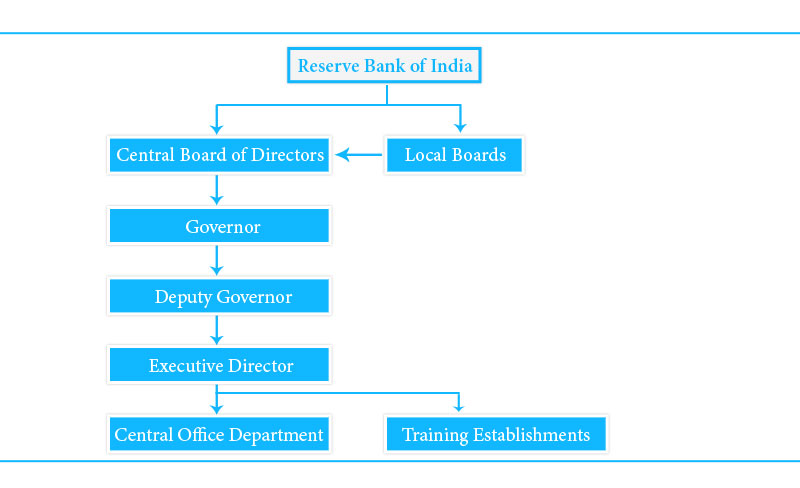

As per the Reserve Bank of India Act, the organizational structure of the Reserve Bank comprises of:

A. Central Board

B. Local Boards

A. Central Board –

The Central Board of Directors is the leading governing body of the bank. It is entrusted with the responsibility of general superintendence and direction of the affairs and business of the Reserve Bank.

The Central Board of Directors consists of 20 members as follows:-

One Governor and four Deputy Governors:

They are appointed by the Government of India for a period of five years.Their salaries, allowances and other perquisites are determined by the Central Board of Directors in consultation with the Government of India.

Four Directors Nominated from the Local Boards:

There are four local Boards of Directors in addition to the Central Board of Directors. They are located at Mumbai, Kolkata, Chennai and New Delhi. The Government of India nominates one member each from these local Boards. The tenure of these directors is also for a period of five years.

Ten other Directors:

The ten other directors of the Central Board of Directors are also nominated by the Government of India. Their tenure is four years.

One Government Official:

The Government of India also appoints one Government Official to attend the meetings of the Central Board of Directors. This official can continue for any number of years with the consent of the Government, but he does not enjoy the right to vote in the meetings of the Central Board.

B. Local Boards-

The Reserve Bank of India is divided into four regions :

-

-

- The Western, the Eastern, the Northern and the Southern regions. For each of these regions, there is a Local Board, with headquarters in Mumbai, Kolkata, New Delhi and Chennai.

-

-

-

- Each Local Board consists of five members appointed by the Central Government for four years.

-

-

-

- They represent territorial and economic interests and the interests of co-operative and indigenous banks in their respective areas.

-

-

-

- In each Local Board, a chairman is elected from amongst their members. Managers incharge of the Reserve Bank’s offices in Mumbai, Kolkata, Chennai and New Delhi are ex-officio Secretaries of the respective Local Boards at these places.

-

Functions

Functions

According to the preamble of the Reserve Bank of India Act, the main functions of the bank is “to regulate the issue of bank notes and the keeping of reserves with a view to securing monetary stability in India and generally to operate the currency and credit system of the country to its advantage.” The various functions performed by the RBI can be conveniently classified in three parts as follows:

A. Central banking function

B. Promotional functions

C. Supervisory functions

A. Central Banking Functions

"Issue of Currency :

Under Section 22 of the Reserve Bank of India Act, the Bank has the sole right to issue bank notes of all denomination. The distribution of one rupee notes and coins and small coins all over the country is undertaken by the Reserve Bank as agent of the Government. The Reserve Bank has a separate Issue Department which is entrusted with the issue of currency notes.

Note: The One Rupees notes and coins are issued by the Central Govt., The Ministry of Finance.

Banker to the Government :

The Reserve Bank of India serves as a banker to the Central Government and the State Governments. It is its obligatory function as a central bank. It provides a full range of banking services to these Governments, such as:-

a. Maintaining and operating of deposit accounts of the Central and State Government.

b. Receipts and collection of payments to the Central and State Government.

c. Making payments on behalf of the Central and State Government.

d. Transfer of funds and remittance facilities of the Central and State Governments.

e. Managing the public debt and issue of new loans and Treasury Bills of the Central Government.

f. It acts as adviser to the Government on all monetary and banking matters.

g. It accepts money, makes payment and also carries out their exchange and remittances for the Govt.

h. Providing ways and means advances to the Central and State governments to bridge the interval between expenditure and flow of receipts of revenue. Such advances are to be repaid by the government within three months from the date of borrowable.

Banker’s Bank :

The RBI has extensive power to control and supervise commercial banking system under the RBI Act, 1934 and the Banking Regulation Act, 149.

(i) The Banks are required to maintain a minimum of Cash Reserve Ratio (CRR) with RBI.

(ii) The RBI provides financial assistance to scheduled banks and state cooperative banks.

(iii) Enables banks to maintain their accounts with RBI for statutory reserve requirements and maintenance of transaction balances.

Lender of the Last Resort:

Lender of the last resort means “Central Bank (RBI) helps all the commercial and other banks in time of financial crises.

(i) It can come to the rescue of a bank that is solvent but faces temporary liquidity problems by supplying it with much needed liquidity when no one else is willing to extend credit to that bank.

(ii) The Reserve Bank extends this facility to protect the interest of the depositors of the bank and to prevent possible failure of the bank, which in turn may also affect other banks and institutions and can

have an adverse impact on financial stability and thus on the economy.

National Clearing House :

The Reserve Bank acts as the national clearing house and helps the member banks to settle their mutual indebtedness without physically transferring cash from place to place. The Reserve Bank is managing many clearing houses in the country with the help of which cheques worth crores of rupees are cleared every year. The ultimate balances are settled by the banks through cheques on the Reserve Bank.

Controller of credit:

Credit control is generally considered to be the principal function of Central Bank. By making frequent changes in monetary policy, it ensures that the monetary system in the economy functions according to the nation’s need and goals.

(i) It can do so through changing the Bank rate or through open market operations.

(ii) It controls the credit operations of banks through quantitative and qualitative controls.

(iii) It controls the banking system through the system of licensing, inspection and calling for information.

Custodian of foreign exchange reserves :

The RBI functions as the custodian and manager of forex reserves, and operates within the overall policy framework agreed upon with Government of India.

(i) The ‘ reserves ’ refer to both foreign reserves in the form of gold assets in the Banking Department and foreign securities held by the Issue Department, and domestic reserves in the form of ‘bank reserves’.

(ii) Foreign exchange reserves are important indicators of ability to repay foreign debt and for currency defense, and are used to determine credit ratings of nations.

(iii) Its commonly includes foreign exchange and gold, special drawing rights,(SDRs) and International Monetary Fund(IMF) reserve positions.

B. Promotional Functions:

Reserve Bank of India and Agricultural Credit:

-

-

- The bank’s responsibility in this field has been occasioned by the predominantly agricultural basis of the Indian economy and the urgent need to expand and coordinate the credit facilities available to the rural sector.

-

-

-

- The RBI has set up a separate agricultural department to maintain an expert staff to study all questions of agricultural credit and coordinate the operation of the bank with other agencies providing agricultural finance.

-

-

-

- The RBI does not provide finance directly to the agriculturists, but through agencies like cooperative banks, land development banks, commercial bank etc.

-

-

-

- After the establishment of the National Bank for Agriculture and Rural Development (NABARD) on July 12, 1982, all the functions of the RBI relating to rural credit have been transferred to this new agency.

-

-

-

- The Reserve Bank of India has taken initiative in setting up statutory corporations at the all-India and regional levels to function as specialised institutions for term lending.

-

-

-

- The first of these institutions was the Industrial Finance Corporation of India set up in 1948. Followed by the State Finance Corporations in each of the state from 1953 onwards.

-

-

-

- The RBI has also helped in the establishment of other financial institutions such as the Industrial Development Bank of India, the Industrial Reconstruction Bank of India, Small Industries Development Bank of India, Unit Trust of India, etc.

-

-

-

- For the promotion of foreign trade the Reserve Bank has established the Export and Import Bank of India. Similarly, for the development of the housing industry the RBI has established the National Housing Bank.

-