Introduction

Introduction

IBPS PO 2019 – Main Examination, conducted in online Mode, has: a duration of 3 hours, 4 Sections, a total of 155 questions, a Maximum score of 200 marks, and, is followed by a Descriptive Test (English language) for a duration of 30 minutes. The 4 Sections are timed: Reasoning & Computer Aptitude, General/ Economy/ Banking Awareness, English language, Data Analysis & Interpretation. The section wise details are as shown below. The objective test is followed by a Descriptive Paper (Essay Writing + Letter Writing)

Pattern

Pattern

| S.No. | Name of Test (NOT BY SEQUENCE) | No. of Questions | Maximum Marks | Medium of Exam | Time Allotted for Each Test (Separately Timed) |

|---|---|---|---|---|---|

| 1 | Reasoning & Computer Aptitude | 45 | 60 | English & Hindi | 60 minutes |

| 2 | General/Economy/Banking Awareness | 40 | 40 | English & Hindi | 35 minutes |

| 3 | English Language | 35 | 40 | English | 40 minutes |

| 4 | Data Analysis and Interpretation | 35 | 60 | English & Hindi | 45 minutes |

| TOTAL | 155 | 200 | 3 hours | ||

| 5 | English Language (Letter Writing & Essay) | 2 | 25 | English | 30 minutes |

Syllabus

Syllabus

Syllabus - IBPS PO General Awareness/Economy/Banking Awareness - Main Examination

| S.No. | Topics |

|---|---|

| 1 | Banking and Insurance Awareness |

| 2 | Financial Awareness |

| 3 | Govt. Schemes and Policies |

| 4 | Current Affairs |

| 5 | Static GK |

Quiz

Quiz

1. The Government reduced the Employees State Insurance (ESI) contribution rate from 6.5% to ____.

- A. 4%

B. 4.5%

C. 5%

D. 5.5%

E. 6.5%

- A. Termination Value

B. Maturity Value

C. Surrender Value

D. Pre-mature Value

E. Holder Value

- A. Hazards

B. Vesting

C. Arbitration

D. Perils

E. Concealment

- A. PMJJBY stands for ‘Pradhan Mantri Jeevan Jyoti Bima Yojana’

B. People in the age group of 18 to 50 having bank account are eligible for scheme

C. The premium payable is Rs.300/- per annum per subscriber.

D. The scheme offers a risk Coverage of Rs.2 Lakh in case of death for any reason

E. All the given statements are true

- A. UDYAM

B. Skill Insurance

C. MANORATH

D. Skill India

E. SHRAM

1. LIC formed by an Act of Parliament, viz. LIC Act, 1956, with a capital contribution of Rs. ______ from the Government of India.

- A. 5 Crore

B. 10 Crore

C. 50 Crore

D. 100 Crore

E. 500 Crore

- A. Metlife Insurance Company

B. Aviva Insurance Company

C. ING Insurance Company

D. Allianz Insurance Company

E. AXA Insurance Company

- A. Manila

B. New Delhi

C. Singapore

D. Hyderabad

E. London

- A. NESL

B. SEBI

C. NSDL

D. CDSL

E. BSE

- A. National Housing Bank (NHB)

B. Housing Development Finance Corporation (HDFC)

C. India Mortgage Guarantee Corporation (IMGC)

D. PNB Housing Finance Ltd.

E. L & T Finance Ltd.

1. The premium charged by the insurer must incorporate the risk premium that covers not only the claims but also the capital requirements, also called the ________.

- A. Liability Requirements

B. Reinsurance

C. Term Insurance

D. General Insurance

E. Solvency Requirements

- A. Fire and Burglary

B. Riot and Strike

C. Terrorism Act

D. Drunken driving

E. Flood and Storm

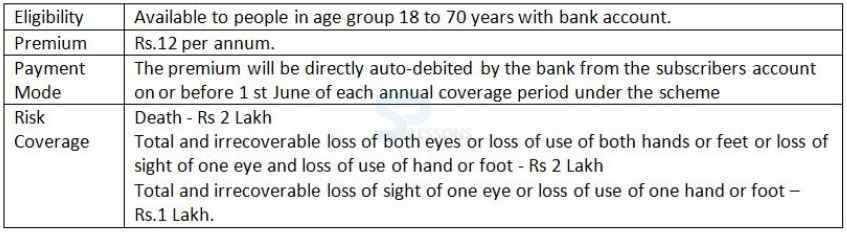

- A. PMSBY stands for ‘Pradhan Mantri Suraksha BimaYojana’

B. All individual (single or joint) bank account holders in the 18-70 year age group are eligible for scheme

C. The premium payable is Rs 18 per annum per member

D. The risk coverage available is Rs 2 lakh for accidental death and permanent total disability, and Rs 1 lakh for permanent partial disability

E. All of the above

- A. Fino Payments Bank

B. Airtel Payments Bank

C. Jio Payments Bank

D. Paytm Payments Bank

E. India Post Payments Bank

- A. Bajaj Allianz General Insurance

B. Bharti AXA General Insurance

C. HDFC ERGO General Insurance

D. National Insurance Company Limited

E. Reliance General Insurance