Introduction

Introduction

Conceptualized by the Central Bank or the Reserve Bank of India (RBI), Payments Bank is a new model of banks that accept a restricted deposit. Under the Companies Act, 2013, Payments Banks have to be registered as public limited companies. The deposit is currently restricted to INR 1 lakh per customer.

However, this may increase in the future. These banks cannot issue loans and credit cards, but, can operate current and savings account. It is for this reason that the term ‘payments’ is used to differentiate from other banks.

Note: Bharti Airtel was the first live Payments Bank set up in India.

Advantages

Advantages

The two principal advantages of Payments Bank are:

1. Interest rates:

- A commercial bank offers an interest rate of 3.5 to 6 percent on its deposits.

- However, Payments banks offer a better interest which can be as high as 7.25% in some cases. But, they have a statutory limit of INR 1 lakh per individual and small businesses.

- Unlike commercial banks, Payments banks offer a zero balance account with no hidden charges.

Example: The Paytm Payments Bank offers a saving account with no account opening charges. Therefore, a customer can enjoy the convenience of banking on mobiles with no extra fees.

Activities

Activities

Scope of Activities:

Licensed under the Banking Regulation Act, 1949, Payments Banks are given the status of the scheduled banks under Section 42 (6) (a) of the RBI, 1934.

All Payments Banks can perform the following set of activities:

- Acceptance of demand deposits within the limit specified.

- Issuance of ATM and debit cards.

- Various channels provide payment and remittance services.

- As per the guidelines of the RBI, Payments Banks can act as business correspondents.

- Undertake utility bill payments on behalf of the customers and the general masses.

- Distribution of non-risk sharing simple financial instruments like mutual fund units and insurance products.

- Offer Internet Banking services with compliance with the RBI instructions.

Funds

Funds

Deployment of Funds:

- Payment Banks cannot undertake lending activities.

- They shall invest a minimum of 75% of its demand deposit balances in the Statutory Liquidity Ratio (SLR).

- They can hold a maximum of 25% in current and fixed deposits with the scheduled commercial banks for operational purposes and liquidity management.

Requirement

Requirement

Capital Requirement:

1. Payments Banks are required to have a minimum paid-up equity capital of INR 100 crore.

Example: ‘Fino Pay Tech Limited’ that is backed by World bank’s IFC and Blackstone acquired Nokia Money in 2012 to launch ‘Alpha Payment Services’ with an initial paid-up equity capital of INR 300 crore.

2. They shall leverage at a ratio of at least 3%. This means that its external liabilities shall not exceed 33.33 times the net worth regarding the paid-up capital and the reserves.

3. The minimum initial contribution of the promoter to the paid-up equity capital should at least be 40% for the first five years from the commencement of the business.

Example: In 2011, Airtel partnered with SBI to form a joint venture for making mobile payments. However, it went unsuccessful. Again, after more than five years, it partnered with Kotak Mahindra Bank to obtain a license with the Payments Bank. Kotak Mahindra Bank is expected to take a 19.9% stake in this joint venture.

4. The Foreign Direct Investment for private banks is notified timely. At present, the permissible limit is 74%.  Application

Application

Procedure for Application:

- Applications should comply with Rule 11 of the BR (Companies) Rules of 1949.

- The application shall be in the format given in Form III.

- Further, the application has to be submitted to the Chief General Manager of the Department of Banking Regulation at Reserve Bank of India. This department is located on the thirteenth floor of the Central Office Building in Mumbai.

Decisions

Decisions

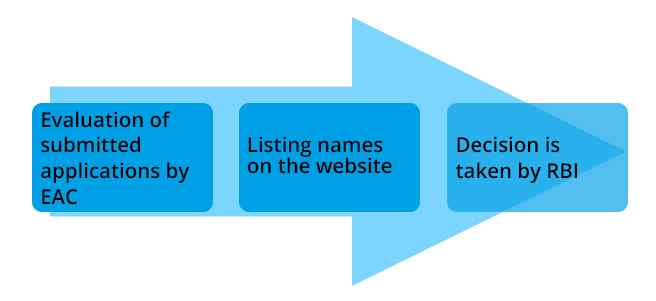

Procedures for RBI Decisions:

- The applications are evaluated by an External Advisory Committee (EAC) which consists of eminent professionals like bankers, C.A.’s, and financial professionals.

- The name of the applicant is listed on the RBI’s websites.

- The decision for approval has to be taken from RBI, and this decision shall be final and binding.

- The approval is valid till the 18 months from the date of issuance from RBI.