Introduction

Introduction

What is meant by Financial Awareness ?

Financial awareness has been linked to such prudent behavior. Conceptually, its foundation is financial literacy, which is defined as: The ability to use knowledge and skills to effectively manage financial resources efficiently at a personal-level and through the life cycle.

Aspirants of LIC Apprentice Development Officer (ADO) 2019, who are willing to enhance their career with insurance sector can check all the details in LIC ADOs 2019 – Official Notification issued by LIC. The online examination Preliminary is scheduled to be conducted in [latex]{6}^{th}[/latex] and [latex]{13}^{th}[/latex] July, 2019 (Tentatively), Mains exam is scheduled to be conducted in [latex]{10}^{th}[/latex] August, 2019 .

Click Here - For Official Website

Financial Awareness is a section that is present in most of the banking competitive exams. Candidates planning to take up employment in the banking sector must be aware of many of the terms policies and other such important information related with financial awareness. The article LIC ADO Financial Awareness Quiz provides quiz sets useful to the candidates while preparing Various Banking & Government Exams like SBI PO, SBI Clerk, SSC CPO, SSC CHSL.

Quiz

Quiz

1. An emerging market economy is highly classified with relatively- one in which the country is becoming a developed nation and is determined through many socio _____

- A. Economic factors

B. External factors

C. Commercial factors

D. GDP factors

E. Growth factors

- A. Rs 1.5 lakh crore

B. Rs 2.5 lakh crore

C. Rs 3.5 lakh crore

D. Rs 4.5 lakh crore

E. Rs 5.5 lakh crore

- A. BOP

B. GDP

C. CDS

D. GNP

E. NPA

- A. Krushak Accommodation for Livelihood and Income Agriculture

B. Krushak Assistance for Livelihood and Income Augmentation

C. Krushak Accommodation for Livelihood and Independent Agriculture

D. Krushak Assistance for Livelihood and Independent Augmentation

E. None of the given options is true

- A. 48 %

B. 42 %

C. 26 %

D. 32 %

E. 56 %

- A. MUDRA

B. SEBI

C. NABARD

D. EXIM

E. RBI

- A. M1

B. M2

C. M3

D. M4

E. M5

- A. Bank Board Bureau

B. Bank Beneficiary Bureau

C. Bank Bureau Board

D. Bank Bureau Beneficiary

E. None of the above

- A. National Spot Exchange Limited (NSEL)

B. Indian Commodity Exchange Limited (ICEX)

C. National Commodity & Derivatives Exchange Limited (NCDEX)

D. Multi-Commodity Exchange of India Ltd (MCX)

E. Securities and Exchange Board of India (SEBI)

- A. 2-7 days

B. 2-14 days

C. 2-21 days

D. 2-28 days

E. 2-90 days

1. Depositor Education and Awareness Fund (DEAF) is maintained by which of the following organisation?

- A. NABARD

B. RBI

C. Public Provident Fund Authorities

D. SIDBI

E. IRDA

- A. Government of India

B. Corporate

C. Primary dealers (PDs)

D. Only a) and b) is correct

E. Only b) and c) is correct

- A. Headline Inflation

B. Core Inflation

C. Consumer Inflation

D. Real Inflation

E. Nominal Inflation

- A. Agriculture

B. Education

C. Renewable Energy

D. Housing Loans

E. Export Import Credit

- A. Tools and Equipment

B. Amounts receivable

C. Capital Stock

D. Cash

E. All of these

- A. Yes Bank

B. HDFC Bank

C. State Bank of India

D. ICICI Bank

E. Punjab National Bank

- A. PradhanMantriFasalBimaYojana

B. AtalBhujalYojana

C. Atal Mission for Rejuvenation and Urban Transformation

D. PradhanMantriGaribKalyanYojana

E. Atal Pension Yojana

- A. Rs 25,000

B. Rs 5,000

C. Rs 50,000

D. Rs 1,00,000

E. Rs 1,50,000

- A. 8.0%

B. 8.1%

C. 8.2%

D. 8.3%

E. 8.4%

- A. 20 lakh rupees

B. 10 lakh rupees

C. 80 lakh rupees

D. 30 lakh rupees

E. 14 lakh rupees

-

(i) Agriculture

(ii) Micro, Small and Medium Enterprises

(iii) Export Credit

(iv) Education

(v) Housing

(vi) Social Infrastructure

(vii) Renewable Energy

(viii) Others

1. Ministry of Housing & Urban Affairs has extended the Credit-Linked Subsidy Scheme (CLSS) for Middle Income Group (MIG) Scheme by another 12 months till _____

- A. March 31, 2020

B. April 30, 2020

C. June 30, 2020

D. January 1, 2020

E. None of these

- A. Telangana

B. Kerala

C. Odisha

D. Bihar

E. None of these

- A. Rs 12,540 crore

B. Rs 10,900 crore

C. Rs 13,678 crore

D. Rs 15,243 crore

E. None of these

- A. USD 100 million

B. USD 400 million

C. USD 300 million

D. USD 200 million

E. None of these

- A. Rs 1.5 crore

B. Rs 2 crore

C. Rs 2.5 crore

D. Rs 3 crore

E. None of these

- A. 12

B. 11

C. 10

D. 9

E. 8

- A. Upliftment of population lying Below Poverty Line

B. Connecting every Indian to the Country’s Banking System

C. Ensuring bank finance to all the landless agriculturists

D. Overall financial growth backed by inflation control

E. Inclusion of latest technology in Financial Sector of the country

- A. 15

B. 17

C. 22

D. 24

E. None of these

- A. Deflation

B. Market capitalization

C. Negative growth

D. Discount yield

E. None of these

- A. Gold

B. Special Drawing Rights (SDRs)

C. International Monetary Fund (IMF) reserve position

D. GOI Bonds issued overseas

E. Foreign Currency assets

-

1) Foreign Currency Assets

2) Gold

3) Special Drawing Rights (SDRs)

4) Reserve Tranche Position in the IMF

1. Which of the following component of external sector comes under Current Account in India?

- A. FDI

B. Interest payments received by government

C. External Commercial Borrowings

D. FII

E. NRI bank account

- A. Consider it as a stale cheque

B. Clear the cheque by taking in account value written in words

C. Clear the cheque by taking in account value written in digits

D. Reject cheque and impose fine double the value of cheque

E. None of the above

- A. RBI advances money to Government whenever there is any emergency

B. Commercial banks has to keep their funds with the RBI

C. It comes to help banks in times of crisis

D. All of the above

E. None of the above

- A. The payee can obtain payment only through a bank account

B. The payee is compelled to open an account

C. The payee will have to endorse the cheque to a bank

D. All of the above

E. None of these

- A. Inflation + Fiscal Deficit

B. Current Account Deficit + Fiscal Deficit

C. Capital Account Deficit + Fiscal Deficit

D. Primary Deficit + Capital Account Deficit

E. Revenue Deficit + Fiscal Deficit

- A. 50 Crore

B. 10 Crore

C. 100 Crore

D. 25 Crore

E. 5 Crore

- A. 26%

B. 74%

C. 42%

D. 49%

E. 69%

- A. 2%

B. 4%

C. 6%

D. 5%

E. 3%

- A. 60000 Crore

B. 105000 Crore

C. 85000 Crore

D. 65000 Crore

E. 90000 Crore

- A. 10

B. 12

C. 15

D. 20

E. 25

1. For which of the following debt instruments, not having a fixed rate of interest over the life of the instrument, can ‘Floating Interest Rate’ be applied?

- A. A loan

B. A bond

C. A mortgage

D. A credit

E. All of these

- A. CAR

B. CRR

C. CAR and CRR

D. CRR and SLR

E. SLR

- A. No bad debts to banks and no suits for recovery

B. No interest earning for banks

C. Works like a normal withdrawal slip

D. 45 days credit is given to the card holder

E. All of the above

- A. Banking Option

B. Stock Market Option

C. Branding

D. Financial Planning

E. Mutual Fund Benefit

- A. Rupee denominated domestic bonds

B. Rupee denominated overseas bonds

C. Dollar denominated overseas bonds

D. Dollar denominated domestic bonds

E. None of these

- A. 2 Crore

B. 1 Crore

C. 50 thousand

D. 1 Lakh

E. None of these

- A. PradhanMantriKshetraVikasYojna

B. Pradhan Mudra KhanijVikasYojna

C. PradhanMantriKaushalVikasYojna

D. Pradhan Mudra KaushalVikasYojna

E. None of these

- A. Rs.8750 per month

B. Rs.9750 per month

C. Rs.7550 per month

D. Rs.8550 per month

E. None of these

- A. USD 20 Million

B. USD 40 Million

C. USD 50 Million

D. USD 60 Million

E. None of these

- A. Micro Debit

B. Micro Bachat

C. Micro Loan

D. Micro Fund

E. None of these

1. Which of the following is not a feature of gilt edged securities?

- A. Issued by non-governmental service organization

B. Issued by government entities

C. Repayment of both principal and interest is secured

D. They have zero default risk

E. All of them

- A. Portfolio risk

B. Systematic risk

C. Unsystematic risk

D. Business risk

E. Financial risk

- A. Difference between market return and risk free rate

B. Difference between stock return and risk free rate

C. Difference between market return and stock return

D. Beta times the risk free rate

E. Beta times the market return

- A. Low fixed costs relative to variable costs

B. High fixed costs relative to variable costs

C. High selling price per unit relative to others

D. Low selling price per unit relative to others

E. High total costs relative to selling price per unit

- A. High operating risk

B. High debt to equity

C. High Earning per share

D. High Sales

E. High EBIT

- A. $8 billion

B. $4 billion

C. $5 billion

D. $10 billion

E. $20 billion

- A. Rs 15

B. Rs 5

C. Rs 20

D. Rs 10

E. Rs 25

- A. $135 million

B. $137 million

C. $140 million

D. $145 million

E. $147 million

- A. Rs 25 lakh

B. Rs 15 lakh

C. Rs 20 lakh

D. Rs 10 lakh

E. Rs 8 lakh

- A. USD 250 million

B. USD 225 million

C. USD 200 million

D. USD 100 million

E. USD 350 million

1. The market price of a share of common stock is determined by ________

- A. The board of directors of the firm.

B. The stock exchange on which the stock is listed.

C. The president of the company.

D. Individuals buying and selling the stock.

E. Securities and Exchange Board of India

- A. Debt can be raised for finite time periods

B. Debt, unlike equity finance, will not need to be secured against assets

C. Debt is cheaper than equity finance

D. Interest payments are tax-deductible

E. Debt finance can be raised more quickly than equity finance

- A. A small change in sales results in a large change in net income.

B. A small change in sales results in a small change in net income.

C. A small change in earnings before interest and taxes result in a small change in net income.

D. A small change in net income results in a small change in the firm’s earnings before interest and taxes.

E. A small change in the number of units a firm produces and sells result in a similar change in the firm’s earnings before interest and taxes

- A. Students and Ministers Engagement Program

B. Students and MEA Enrolment Program

C. Students and MEA Engagement Program

D. Students and MEA Encouragement Program

E. Students and MEA Effort Program

- A. Savings function

B. Liquidity function

C. Risk function

D. Social function

E. Policy function

- A. Rs 40,400 crore

B. Rs 37,500 crore

C. Rs 33,300 crore

D. Rs 42,500 crore

E. Rs 47,800 crore

- A. Rs 3,454 crore

B. Rs 4,555 crore

C. Rs 2,159 crore

D. Rs 5,654 crore

E. Rs 2,353 crore

- A. 10.3%

B. 11.1%

C. 10.8%

D. 11.3%

E. 10.5%

- A. Rs 1.45 lakh

B. Rs 96,500

C. Rs 1.01 lakh

D. Rs 1.25 lakh

E. Rs 86,000

- A. 7.4%

B. 6.9%

C. 7.2%

D. 7.5%

E. 8.1%

1. When an agent asks a customer to invest in a mutual fund product without telling him/her about the risks involved in the investment, the process is termed as_________

- A. Mis-selling

B. Undertaking

C. Misappropriation of funds

D. cross-selling

E. None of the given options is true

- A. Purchase of securities to cover the sale

B. Sale of securities to reduce the loss on purchase

C. The simultaneous purchase and sale of an asset to profit from an imbalance in the price

D. Variation in different markets

E. All of the above

- A. Cash crunch

B. Liquidity

C. Credit

D. Marketability

E. None of the given options is true

- A. Insider trading

B. Future trading

C. Foreign trading

D. Stock trading

E. None of the given options is true

- A. Probability risk

B. Market risk

C. Inflation risk

D. Credit risk

E. None of the given options is true

- A. 1.45 crore

B. 1.32 crore

C. 1.85 crore

D. 1.37 crore

E. 1.83 crore

- A. 7.5%

B. 7.0%

C. 7.7%

D. 7.8%

E. 7.9%

- A. Rs. 6000 crore

B. Rs. 6500 crore

C. Rs. 7000 crore

D. Rs. 7500 crore

E. Rs. 8000 crore

- A. Rs 50 and Rs 100

B. Rs 100 and Rs 5

C. Rs 350 and Rs 100

D. Rs 10 and Rs 350

E. Rs 10 and Rs 100

- A. India

B. USA

C. China

D. Russia

E. Germany

1. Which of the following is not considered as a means of foreign capital inflow into the country?

- A. FDI

B. FCNR accounts

C. FII

D. No frills account

E. None of these

- A. Bear hug

B. Dividend

C. Insider trading

D. Interest rate

E. Sensex

- A. Participatory notes

B. Foreign currency non-resident accounts

C. Foreign currency convertible bonds

D. Nostro accounts

E. None of these

- A. 3 years

B. 5 years

C. 9 years

D. 15 years

E. 18 year

- A. Cash crunch

B. Liquidity

C. Credit

D. Marketability

E. None of these

- A. Rs. 1.5 lakh

B. Rs. 1.0 lakh

C. Rs. 1.3 lakh

D. Rs. 1.4 lakh

E. Rs. 1.2 lakh

- A. Rs.1 crore, Rs.50 lakhs

B. Rs.2 crore, Rs.1.5 crore

C. Rs.2 crore, Rs.1 crore

D. Rs.1.5 crore, Rs.75 lakhs

E. Rs.5 crore, Rs.2.5 crore

- A. Rs. 79 crores

B. Rs. 59 crores

C. Rs. 90 crores

D. Rs. 110 crores

E. Rs. 45 crores

- A. Life Insurance Company

B. TCS

C. HDFC

D. Flipkart

E. Paytm

- A. e-Bandhan

B. e-Suraksha

C. e-Rythu

D. e-Friendly

E. e-Agri

1. If Indian govt. decides the level of Rupee to be 57 from 55 against 1 dollar, it is called ________.

- A. Depreciation

B. Devaluation

C. Appreciation

D. Revaluation

E. Demonetisation

- A. Overwriting

B. Liability

C. Underwriting

D. Writing-off

E. Writing-on

- A. 3-5

B. 4-6

C. 4-5

D. 3-4

E. 5-6

- A. Over Rs. 1000 crores

B. Over Rs. 500 crores

C. Over Rs. 100 crores

D. Over Rs. 50 crores

E. Over Rs. 200 crores

- A. HDFC Securities

B. PNB Securities

C. SBI Securities

D. ICICI Securities

E. Axis bank Securities

- A. Rs. 52,000 crores

B. Rs. 87,000 crores

C. Rs. 50,000 crores

D. Rs. 46,000 crores

E. Rs. 10,000 crores

- A. Karnataka

B. West Bengal

C. Rajasthan

D. Maharashtra

E. Andhra Pradesh

- A. 7.2%

B. 7.8%

C. 8.6%

D. 8.2%

E. 8.4%

- A. 20 lakh rupees

B. 40 lakh rupees

C. 50 lakh rupees

D. 10 lakh rupees

E. 30 lakh rupees

- A. 30 crore

B. 34 crore

C. 29 crore

D. 50 crore

E. 19 crore

1. Which of the following statement is/are correct regarding the MCLR?

- A. It is the minimum interest rate of a bank below which it cannot lend

B. It is an internal benchmark or reference rate for the bank

C. The MCLR methodology has replaced the base rate system

D. The aim of MCLR is to improve the transmission of policy rates into the lending rates of banks

E. All of the above

- A. Follow-On Public Offering

B. Initial Public Offering

C. Offer for sale method

D. Private placement of securities

E. Tender Method

- A. Budget Deficit

B. Expenditure Deficit

C. Revenue Deficit

D. Receipts Deficit

E. None of the above

- A. Only I and II are correct

B. Only III is correct

C. Only II is correct

D. All are correct

E. None are correct

- A. 11

B. 12

C. 13

D. 17

E. 10

- A. West Bengal

B. Uttar Pradesh

C. Odisha

D. Maharashtra

E. Gujarat

- A. 4,000

B. 5,000

C. 6,000

D. 7,000

E. 8,000

- A. 3

B. 4

C. 5

D. 6

E. 7

- A. 330

B. 260

C. 350

D. 250

E. 450

- A. 2.8

B. 3.1

C. 3.4

D. 3.5

E. 3.8

-

a) It is an internal benchmark or reference rate for the bank.

b) MCLR actually describes the method by which the minimum interest rate for loans is determined by a bank.

c) MCLR is decided on the basis of marginal cost or the additional or incremental cost of arranging one more rupee to the prospective borrower.

1. The IFAD is an international financial institution and a specialized agency of the United Nations dedicated to eradicating poverty and hunger in rural areas of developing countries. IFAD stands for

- A. International Fund for Agricultural Derivative

B. International Fund for Association Development

C. Indian Fund for Agricultural Development

D. International Fund for Agricultural Development

E. International Financial for Agricultural Development

- A. A deposit account with a public-sector bank

B. A depository account with any of the depositories in India

C. An instrument in the form of depository receipt created by an Indian depository against underlying equity shares of the issuing company

D. An instrument in the form of deposit receipt issued by Indian depositories

E. None of the given options is true

- A. Mis-selling

B. Undertaking

C. Misappropriation of funds

D. cross-selling

E. None of the given options is true

- A. Sensex

B. Footsie

C. Nifty

D. Bullish

E. None of the given options is true

- A. Cash crunch

B. Liquidity

C. Credit

D. Marketability

E. None of the given options is true

- A. 3.2

B. 3.4

C. 3.6

D. 3.8

E. 4.0

- A. 6.2 percent

B. 7.0 percent

C. 6.8 percent

D. 6.5 percent

E. 5.7 percent

- A. 2%

B. 3%

C. 1%

D. 4%

E. 5 %

- A. Rs. 15 lakh

B. Rs. 25 lakh

C. Rs. 45 lakh

D. Rs. 65 lakh

E. Rs. 72 lakh

- A. Rs. 15000

B. Rs. 20000

C. Rs. 25000

D. Rs. 18000

E. Rs. 16000

1. In a company, the use of price-sensitive corporate information by the company people to make gains or cover losses is known as___________-

- A. Insider trading

B. Future trading

C. Foreign trading

D. Stock trading

E. None of the given options is true

- A. Single Exchange Processing Agency

B. Single Euro Payments Area

C. Single Electronic Processing Agency

D. Super Electronic Purchase Agency

E. None of these

- A. Development bonds

B. Insurance policies

C. Mutual funds

D. Sovereign wealth funds

E. None of the given options is true

- A. Probability risk

B. Market risk

C. Inflation risk

D. Credit risk

E. None of the given options is true

- A. Electronic Traded Funds

B. Exchange Time Funds

C. Exchange Traded Finance

D. Exchange Traded Flows

E. Exchange Traded Funds

- A. Rs.1.8 lakh

B. Rs.1.6 lakh

C. Rs.2.4 lakh

D. Rs.2.8 lakh

E. Rs.2.2 lakh

- A. Rs. 1 crore

B. Rs. 2 crores

C. Rs. 3 crores

D. Rs. 5 crores

E. Rs. 1.5 crores

- A. Paytm

B. Mobikwik

C. PhonePe

D. GooglePay

E. AmazonPay

- A. MTNL

B. Airtel

C. Jio

D. BSNL

E. Idea

- A. Punjab National Bank

B. ICICI Bank

C. Bank of Baroda

D. State Bank of India

E. Allahabad Bank

1. A debt which is irrecoverable and is therefore written off as loss in the accounts of an institution or bank is known as __________

- A. External debt

B. Good debt

C. Bad debt

D. Internal deb

E. None of these

- A. Venture Capital

B. Working Capital

C. Equitable Mortgage

D. Loss Assets

E. Profit and Loss Account

- A. Bond

B. Securities

C. Stock

D. Funds of Fund

E. None of the given options is true

- A. Conversion of money which is illegally obtained

B. Conversion of money which is legally obtained

C. All converted money

D. All of the above

E. None of the given options is true

- A. Public revenue and Expenditure

B. Issue of Currency

C. Export Import

D. Population Control

E. Education for all

- A. 110 and 402

B. 105 and 390

C. 115 and 425

D. 101 and 420

E. 110 and 420

- A. Rs. 2 lakh

B. Rs. 5 lakh

C. Rs. 1 lakh

D. Rs. 3 lakh

E. Rs. 4 lakh

- A. Rs. 5 lakh

B. Rs. 1 crore

C. Rs. 50 lakh

D. Rs. 5 crore

E. Rs. 2 crore

- A. ICICI Bank

B. HDFC Bank

C. Punjab National Bank

D. State Bank of India

E. Bank of India

- A. Rs. 100 Crore

B. Rs. 200 Crore

C. Rs. 300 Crore

D. Rs. 500 Crore

E. Rs. 50 Crore

1. EFTPOS (electronic funds transfer at point of sale) is based on___________

- A. SMS Alerts

B. Debit Cards

C. Credit Cards

D. Both a) and b)

E. Both b) and c)

- A. Collateral

B. Underwriting

C. Letter of Credit

D. Bank guarantee

E. Other than the given option

- A. Recession

B. Depreciation

C. Stagflation

D. Depression

E. None of these

- A. Central

B. Critical

C. Commercial

D. Core

E. Capital

- A. Banking Regulation Act, 1949

B. The Banking Companies Act–1949

C. Chit Fund Act–1982

D. Negotiable Instrument Act, 1881

E. Other than the given options

- A. Andhra Pradesh

B. Telangana

C. Kerala

D. Manipur

E. None of these

- A. 2467 crore

B. 3826 crore

C. 4618 crore

D. 6084 crore

E. None of these

- A. 5000 crore

B. 6000 crore

C. 7000 crore

D. 8000 crore

E. None of these

- A. 2%

B. 3%

C. 4%

D. 5%

E. None of these

- A. 7,000

B. 9,000

C. 11,000

D. 17,000

E. None of these

1. What is the duration(years) after which a savings account will be treated as inoperative/dormant if there are no transactions in the account?

- A. 1

B. 2

C. 3

D. 4

E. 5

- A. SWIFT

B. TIPS

C. NEFT

D. MPIJ

E. RTGS

- A. Allahabad Bank

B. UCO Bank

C. ICICI

D. HDFC

E. State Bank of India

- A. Soft Currency

B. Hard Currency

C. Hot Money

D. Cheap Money

E. None of these

- A. Pledge

B. Hypothetical

C. Mortgage

D. Lien

E. All of these

- A. 7.6 %

B. 7.2 %

C. 7.4 %

D. 7.7 %

E. None of these

- A. 7.3 %

B. 7.2 %

C. 7.6 %

D. 7.7 %

E. None of these

- A. Rs. 1.5 crore

B. Rs. 2 crore

C. Rs. 2.5 crore

D. Rs. 3 crore

E. None of these

- A. Telangana

B. Gujarat

C. Sikkim

D. Arunachal Pradesh

E. None of these

- A. Rs. 250

B. Rs. 150

C. Rs. 350

D. Rs. 200

E. None of these

1. Pradhan Mantri Vaya Vandana Yojana (PMVVY)’ aims to provide social security during old age. What is the minimum purchase price under the scheme for a minimum pension of Rs. 1,000/- per month ?

- A. Rs.1,20,000

B. Rs.1,00,000

C. Rs.1,25,000

D. Rs.1,50,000

E. Rs. 2,50,000

- A. Financial risk

B. Currency risk

C. Investment risk

D. Market and finance risk

E. Market risk

- A. Put Option

B. European Option

C. Call Option

D. American Option

E. None of the above

- A. Slate Cheque

B. Anti-dated cheque

C. Bearer Cheque

D. Blank cheque

E. Order Cheque

- A. Informal banking

B. Indigenous banking

C. Shadow banking

D. Development banking

E. Adaptive Banking

- A. Rs. 100,000

B. Rs. 50,000

C. Rs. 500,000

D. Rs. 200,000

E. Rs. 250,000

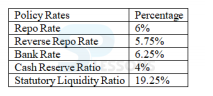

- A. 6.50% and 19.50%

B. 6.25% and 19.25%

C. 6.75% and 19.75%

D. 6.50% and 19.25%

E. 5.75% and 18.50%

- A. Madhya Pradesh

B. West Bengal

C. Bihar

D. Uttarakhand

E. Assam

- A. Rs. 25 Lakh

B. Rs. 10 Lakh

C. Rs. 30 Lakh

D. Rs. 5 Lakh

E. Rs. 20 Lakh

- A. Rs. 25

B. Rs. 50

C. Rs. 100

D. Rs. 75

E. Rs. 150

1. Which among the following is a condition of slow economic growth and relatively high unemployment?

- A. Deflation

B. Bottleneck Inflation

C. Stagflation

D. Reflation

E. Creeping Inflation

- A. 60 days

B. 180 days

C. 30 days

D. 45 days

E. 90 days

- A. 5 years

B. 10 years

C. 3 years

D. 15 years

E. 8 years

- A. 7.3%

B. 7.5%

C. 7.2%

D. 7.6%

E. 7.8%

- A. M1

B. M0

C. M2

D. M3

E. M4

- A. Rs. 15000

B. Rs. 20000

C. Rs. 30000

D. Rs. 10000

E. Rs. 25000

- A. 70 Years

B. 60 Years

C. 65 Years

D. 62 Years

E. 58 Years

- A. 1 January, 2019

B. 1 February, 2019

C. 1 April, 2020

D. 1 June, 2019

E. 1 June, 2020

- A. World Bank

B. International Monetary Fund

C. Asian Development Bank

D. New Development Bank

E. None of these

- A. Madhya Pradesh

B. Uttar Pradesh

C. Arunachal Pradesh

D. Andhra Pradesh

E. Himachal Pradesh

1. PradhanMantriVayaVandanaYojana (PMVVY) is a pension plan for senior citizens managed and operated by Life Insurance Corporation (LIC). Under this scheme pension will be paid for how many years?

- A. 5 years

B. 10 years

C. 6 years

D. 7 years

E. 8 years

- A. BIN Code

B. IFCS code

C. IBC code

D. Swift Code

E. CHIPS

- A. Regional stock exchanges

B. BSE and NSE

C. Over the Counter Exchange of India

D. The Inter-Connected Stock Exchange of India

E. All of the above

- A. Exclude the Finance

B. Lack of Access to Financial Services

C. Overlooking financial impacts of the services.

D. Instability of Financial Services

E. None of the above

- A. Companies Act, 2013

B. SEBI Act, 1992

C. SCRA, 1956

D. RBI Act, 1934

E. None of the above

- A. HDFC Bank

B. Indian Overseas Bank

C. Union Bank of India

D. State Bank of India

E. Bank of Baroda

- A. 28000 crores

B. 10000 Crores

C. 50000 Crores

D. 2000 Crores

E. 1000 Crores

- A. Rs 15,000 crore

B. Rs 30,000 crore

C. Rs 40,000 crore

D. Rs 60,000 crore

E. Rs 75,000 crore

- A. 46.5%

B. 44.4%

C. 40%

D. 45%

E. 42%

- A. 400 crore

B. 450 crore

C. 500 crore

D. 600 crore

E. 750 crore

1. An organization such as a bank or insurance company that buys and sells large quantities of securities is called __________

- A. Major Investor

B. Minor Investor

C. Institutional Investor

D. Giant

E. None of these

- A. Indian Depository Receipt (IDR)

B. Commercial Paper

C. Promissory Note

D. Indian Depository Revenue

E. None of these

- A. RBI

B. SEBI

C. SIDBI

D. IRDA

E. NSE

- A. Interest rate and currency risk

B. Currency risk

C. Interest rate risk

D. Cash flows in different currency

E. None of these

- A. Rs. 200 crore

B. Rs. 300 crore

C. Rs. 500 crore

D. Rs. 600 crore

E. None of these

- A. Rs. 20 crore

B. Rs. 25 crore

C. Rs. 15 crore

D. Rs. 10 crore

E. Rs. 50 crore

- A. 25 lakh

B. 10 lakh

C. 50 lakh

D. 5 lakh

E. 35 lakh

- A. USD 400 million

B. USD 100 million

C. USD 200 million

D. USD 300 million

E. USD 250 million

- A. 40 lakh rupees

B. 35 lakh rupees

C. 38 lakh rupees

D. 45 lakh rupees

E. 30 lakh rupees

- A. 200 crore

B. 50 crore

C. 150 crore

D. 10 crore

E. 100 crore

1. ASBA scheme is related to the purchase of ____.

- A. IPO

B. BCP

C. CCD

D. DTCs

E. None of these

- A. A rise in prices of shares of all companies registered with BSE

B. A rise in prices of shares of all companies registered with NSE

C. An overall rise in prices of top 30 shares of group of companies registered with BSE.

D. A rise in prices of shares of all companies belonging to a group of companies registered with BSE.

E. None of these

- A. Minimum cash reserves

B. Approved Securities

C. Approved Securities

D. Both a) and b)

E. All of the above

- A. Purchase of securities to cover the sale

B. Sale of securities to reduce the loss on purchase

C. Simultaneous purchase and sale of securities to make profits from price

D. Variation in different markets

E. None of the above

- A. Savings bank accounts and fixed deposit accounts

B. Current accounts and fixed deposit accounts

C. Savings bank accounts and floating loan accounts

D. Savings bank accounts and cash accounts

E. Savings bank accounts and current accounts

- A. Rs.8750 per month

B. Rs.9750 per month

C. Rs.7550 per month

D. Rs.8550 per month

E. None of these

- A. PradhanMantriAdarsh Gram Yojana

B. PradhanMantriMatritvaVandanaYojana

C. PradhanMantriShram Yogi MandhanYojana

D. PradhanMantriGraminAwaasYojana

E. None of these

- A. USD 20 Million

B. USD 40 Million

C. USD 50 Million

D. USD 50 Million

E. None of these

- A. 8.65%

B. 8.55%

C. 8.85%

D. 8.75%

E. None of these

- A. 2 Crore

B. 1 Crore

C. 50000

D. 1 Lakh

E. None of these

1. What do you understand by, ‘Asset Reconstruction Companies look for business from banks’?

- A. These companies buy the bad debts from banks at discount

B. They help banks in identifying the potential clients for loans

C. They help banks identify potential clients for infrastructure lending by these companies

D. Both B and C

E. None of these

- A. Revenue Deficit — Interest Payment

B. Fiscal Deficit — Interest Payment

C. Revenue Expenditure — Revenue Receipts

D. Total Expenditure — Total Borrowing

E. Budget deficit— Interest payment

- A. Rs. 25000

B. Rs. 50000

C. Rs. 75000

D. Rs. 100000

E. Rs. 200000

- A. Section 24

B. Section 42

C. Section 26

D. Section 56

E. Both option a) and d)

- A. M2 and M1

B. M4 and M3

C. M1 and M3

D. M3 and M1

E. M0 and M1

- A. 6.3%

B. 5.9%

C. 5.8%

D. 6.1%

E. 6.5%

- A. Rs. 55000 crore

B. Rs. 75000 crore

C. Rs. 30000 crore

D. Rs. 85000 crore

E. Rs.50000 crore

- A. Bangladesh

B. India

C. South Korea

D. China

E. Russia

- A. 3 Lakh

B. 2.5 Lakh

C. 2.75 Lakh

D. 2 Lakh

E. None of these

- A. Corporation Bank, Allahabad Bank and Dhanlaxmi Bank

B. Corporation Bank,Dhanlaxmi Bank and Yes Bank

C. Allahabad Bank, Yes Bank and ICICI Bank

D. HDFC Bank,Union Bank of India and Indian Bank.

E. None of these

1. A ‘Legal Entity Identifier’ is a _____ character identifier that identifies distinct legal entities that engage in financial transactions.

- A. 20

B. 10

C. 15

D. 7

E. 5

- A. Non-Performing

B. Restructured

C. Doubtful

D. Loss

E. Active

- A. 2%

B. 3%

C. 4%

D. 5%

E. 6%

- A. Persons with disabilities

B. Minority Communities

C. Scheduled Casts and Scheduled Tribes

D. Distressed persons other than farmers

E. Other Backward Classes

- A. 1

B. 5

C. 7

D. 0

E. 2

- A. 90,928

B. 75,937

C. 86,610

D. 97,247

E. 1,00,273

- A. 900

B. 845

C. 926

D. 876

E. 918

- A. 7.8%

B. 6.7 %

C. 8.1%

D. 7.3%

E. 7.0%

- A. 20%

B. 30 %

C. 10 %

D. 40 %

E. 25 %

- A. 4

B. 1

C. 2

D. 3

E. 5

1. In National Financial Switch service, the limit per transaction is restricted to less than _________.

- A. ₹ 20000

B. ₹ 25000

C. ₹ 50000

D. ₹ 10000

E. ₹ 40000

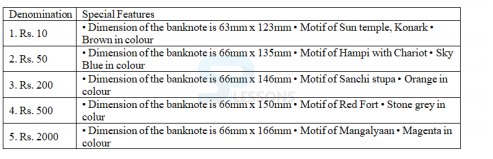

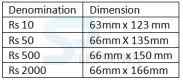

- A. 63 mm * 123 mm

B. 66 mm * 142 mm

C. 66 mm * 150 mm

D. 66 mm * 146 mm

E. 66 mm * 135 mm

- A. Currency Bag

B. Currency Block

C. Currency Chest

D. Currency Reserve

E. None of these

- A. Unpaid Contract Fund

B. Cash Reserve Fund

C. Unclaimed Bank Deposit Fund

D. Inactive Deposit Fund

E. Depositor Education and Awareness Fund

- A. Amazon Pay

B. Mobikwik

C. ICICI salary account

D. Paytm e-wallet

E. None of the above

- A. International Centre for Settlement of Investment Disputes

B. International Bank for Reconstruction and Development

C. International Finance Corporation

D. Multilateral Investment Guarantee Agency

E. International Development Association

- A. Pradhan Mantri Fasal Bima Yojana

B. Atal Bhujal Yojana

C. Atal Pension Yojana

D. Pradhan Mantri Garib Kalyan Yojana

E. Atal Mission for Rejuvenation and Urban Transformation

- A. Rs 1,50,000

B. Rs 1,00,000

C. Rs 50,000

D. Rs 5,000

E. Rs 25,000

- A. USD 1200 million

B. USD 725 million

C. USD 500 million

D. USD 250 million

E. USD 400 million

- A. 20 lakh rupees

B. 30 lakh rupees

C. 10 lakh rupees

D. 60 lakh rupees

E. 50 lakh rupees

1. The maximum value of any prepaid payment instrument, where specific limits have not been prescribed, shall not exceed ______

- A. Rs. 25000

B. Rs. 75000

C. Rs. 50000

D. Rs. 100000

E. None of these

- A. Investing

B. Insurance

C. Real estate

D. Tax planning

E. All of the above

- A. Economic Policy

B. Monetary Policy

C. Fiscal Policy

D. Credit Policy

E. Budgetary Policy

- A. Multinational Banks

B. Multinational Financial Institutions

C. Middle-Income Developing Countries

D. Non-Government Organizations

E. None of the given options is true

- A. Delivery versus Payment (DvP)

B. Negotiated Dealing System (NDS)

C. Risk Mitigation

D. Competition Commission of India (CCI)

E. None of the given options is true

- A. 200 crore

B. 50 crore

C. 150 crore

D. 10 crore

E. 100 crore

- A. Rs 5000 crore

B. Rs 3000 crore

C. Rs 7000 crore

D. Rs 1000 crore

E. Rs 4000 crore

- A. 7.1%

B. 7.5%

C. 7.3%

D. 7.4%

E. 7.2%

- A. AIFI

B. NHB

C. DFI

D. SIDBI

E. NABARD

- A. Rs.3000 Crore

B. Rs.2700 Crore

C. Rs.5000 Crore

D. Rs.1900 Crore

E. None of these

1. Infrastructure Finance Company (IFC) is a non-banking finance company has a minimum Net Owned Funds of _______.

- A. Rs.100 Crore

B. Rs.200 Crore

C. Rs.300 Crore

D. Rs.400 Crore

E. Rs.500 Crore

- A. GDP

B. NDP

C. Per capita real income

D. GNP

E. None of these

- A. Calculative

B. Compound

C. Co-related

D. Credit-linked

E. Cost-linked

- A. A NBFC can accept demand deposits

B. A NBFC can issue cheques

C. Credit Guarantee Corporation is available to depositors of NBFCs

D. A NBFC can extend loans and advances

E. None of the above

- A. Income for government expenditure

B. Interest on unproductive national debt

C. The payments by the household to firm the purchase of goods and services

D. Undistributed profit

E. All of the above

- A. 2

B. 3

C. 4

D. 5

E. 6

- A. 3.1% of GDP

B. 3.5% of GDP

C. 3.4% of GDP

D. 4.4% of GDP

E. 2.8% of GDP

- A. 49%

B. 26%

C. 65%

D. 76%

E. 51%

- A. 24%

B. 14%

C. 49%

D. 76%

E. 51%

- A. Manipur

B. Uttar Pradesh

C. Maharashtra

D. Gujarat

E. Kerala

1. According to RBI guidelines, what is the minimum percent of Capital to Risk Assets Ratio (CRAR) that all Regional Rural Banks (RRBs) must maintain?

- A. 5%

B. 7%

C. 9%

D. 11%

E. 12%

- A. Creeping inflation

B. Deflation

C. Galloping inflation

D. Hyperinflation

E. Stagflation

- A. Rs. 25000

B. Rs. 50000

C. Rs. 2 Lakh

D. Rs. 75000

E. Rs. 1 Lakh

- A. Rs. 10 millions

B. Rs. 50 millions

C. Rs. 100 millions

D. Rs. 25 millions

E. Rs. 40 millions

- A. Substandard

B. Standard

C. Doubtful

D. Loss

E. None of the above

- A. Rs. 35 lakhs

B. Rs. 50 lakhs

C. Rs. 20 lakhs

D. Rs. 25 lakhs

E. Rs. 40 lakhs

- A. Axis Bank

B. ICICI Bank

C. IDBI Bank

D. Kotak Mahindra Bank

E. HDFC Bank

- A. $ 250 million

B. $ 328 million

C. $ 465 million

D. $ 765 million

E. $ 124 million

- A. Jharkhand

B. Chhattisgarh

C. Karnataka

D. Odisha

E. Jammu & Kashmir

- A. International Monetary Fund

B. Asian Development Bank

C. World Bank

D. New Development Bank

E. None of these

1. What is the full form of CBLO?

- A. Coincidental Bank Lending Option

B. Collaterised Borrowing and Lending Facility

C. Call Borrowing and Lending Option

D. Collateralized borrowing and lending obligation

E. None of the above

- A. 2020

B. 2022

C. 2023

D. 2024

E. 2025

- A. Rs.1.5 lakh

B. Rs.2.00 lakh

C. Rs.3.00 lakh

D. Rs.4.00 lakh

E. Rs.5.00 lakh

- A. Financial

B. Fiscal

C. Fund

D. Fasal

E. Future

- A. Local Indian Bank Offered Rate

B. London-India Bureau of Regulations

C. Liberal International Bank Official Ratio

D. London inter-Bank Offered Rate

E. None of the above

- A. Bonds whose maturity value is after 15 years.

B. Bonds in which payment of interest income on the principal is related to a specific price index

C. Bonds issued by Securities and Exchange Board Of India(SEBI)

D. Bonds issued at par

E. Bonds which have Govt. linkage

- A. World Bank

B. Asian Development Bank

C. International Monetary Fund

D. New Development Bank

E. Asian Infrastructure Investment Bank

- A. 20 lakh rupees

B. 30 lakh rupees

C. 10 lakh rupees

D. 60 lakh rupees

E. 50 lakh rupees

- A. Rs. 25000

B. Rs. 75000

C. Rs. 50000

D. Rs. 100000

E. None of these

- A. 1%

B. 2%

C. 1.5%

D. 2.5%

E. 0.5%

1. In India, an Asset Reconstruction Company is regulated by?

- A. MUDRA

B. SEBI

C. NABARD

D. EXIM

E. RBI

- A. M1

B. M2

C. M3

D. M4

E. M5

- A. National Spot Exchange Limited (NSEL)

B. Indian Commodity Exchange Limited (ICEX)

C. National Commodity & Derivatives Exchange Limited (NCDEX)

D. Multi-Commodity Exchange of India Ltd (MCX)

E. Securities and Exchange Board of India (SEBI)

- A. 5,50,000 pieces banknotes/day

B. 4,40,000 pieces banknotes/day

C. 2,20,000 pieces banknotes/day

D. 6,60,000 pieces banknotes/day

E. 7,70,000 pieces banknotes/day

- A. Blue Chip

B. Front Office

C. Currency Chest

D. Holding Company

E. None of these

- A. ICICI Bank

B. City Union Bank

C. Kotak Mahindra Bank

D. Lakshmi Vilas Bank

E. None of these

- A. Rs.90000 crore

B. Rs.75000 crore

C. Rs.25000 crore

D. Rs.50000 crore

E. None of these

- A. Project – 75I

B. Project – 50I

C. Project – 06I

D. Project – 70I

E. None of these

- A. Rs 28000 crore

B. Rs 25000 crore

C. Rs 27000 crore

D. Rs 31000 crore

E. Rs 45000 crore

- A. Rs 47521 crore

B. Rs 48239 crore

C. Rs 45125 crore

D. Rs 51254 crore

E. Rs 58254 crore

1. TDR is a method for controlling land use to complement land-use planning and zoning for more effective urban growth management and land conservation. Expand TDR

- A. Transferable Development Rights

B. Transaction Delayed Reserve

C. Tax Deducted Review

D. Terminal Development Resource

E. None of these

- A. RTGS

B. IMPS

C. NEFT

D. All the above

E. Only A and C

- A. ICICI Bank

B. Punjab National bank

C. Kotak Mahindra Bank

D. HDFC Bank

E. Axis Bank

- A. Unified Payments Interface

B. Bharat Bill Payment System

C. Immediate Payment Service

D. National Common Mobility Card

E. None of these

- A. Closed System Payment Instruments

B. Semi-closed System Payment Instruments

C. Open System Payment Instruments

D. Semi-Open System Payment Instruments

E. None of these

- A. Bank of Mexico

B. Federal Reserve

C. RBI

D. Central Bank of the Russia

E. None of these

- A. 40%

B. 35%

C. 45%

D. 50%

E. 55%

- A. 2025

B. 2035

C. 2050

D. 2030

E. 2040

- A. Rs 2 lakh

B. Rs 5 lakh

C. Rs 1 lakh

D. Rs 4 lakh

E. Rs 10 lakh

- A. PradhanMantriFasalBimaYojana

B. AtalBhujalYojana

C. Atal Pension Yojana

D. PradhanMantriGaribKalyanYojana

E. Atal Mission for Rejuvenation and Urban Transformation

1. Pre-paid Payment Instruments (PPIs) facilitate the purchase of goods and services, including funds transfer, against the value stored on such instruments. Which of the following requirements a does company need to fulfill to issue PPIs in India?

- A. The company should be incorporated in India

B. The company should have a minimum paid-up capital of Rs. 5 crore

C. The company should have a positive net worth of Rs. 1 crore at all the times

D. Only A and B

E. All A, B and C

- A. Rate of one percent per annum above the Reverse Repo Rate

B. Rate of three percent per annum above the Repo Rate

C. Rate of three percent per annum above the Bank Rate

D. Rate of three percent per annum above the Reverse Repo Rate

E. Rate of one percent per annum above the Bank Rate

- A. 95%

B. 93%

C. 107%

D. 95%

E. 92%

- A. 1989

B. 1999

C. 1993

D. 1975

E. 1985

- A. Chennai

B. Jalandhar

C. Kolkata

D. Nashik

E. Guwahati

- A. ICICI Bank

B. RBL Bank

C. South Indian Bank

D. Kotak Mahindra Bank

E. None of these

- A. $ 1.2 billion

B. $ 1.4 billion

C. $ 1.6 billion

D. $ 1.8 billion

E. $ 2.0 billion

- A. World Bank

B. New Development Bank

C. International Monetary Fund

D. Asian Development Bank

E. None of these

- A. 10%

B. 14%

C. 12%

D. 8%

E. 15%

- A. 24%

B. 14%

C. 49%

D. 76%

E. 51%

1. An emerging market economy is highly classified with relatively- one in which the country is becoming a developed nation and is determined through many socio__________

- A. Economic factors

B. External factors

C. Commercial factors

D. GDP factors

E. Growth factors

- A. NABARD

B. RBI

C. Public Provident Fund Authorities

D. SIDBI

E. IRDA

- A. 12

B. 11

C. 10

D. 9

E. 8

- A. A loan

B. A bond

C. A mortgage

D. A credit

E. All of these

- A. FDI

B. Interest payments received by government

C. External Commercial Borrowings

D. FII

E. NRI bank account

- A. Rs. 10,000 crore

B. Rs. 10,200 crore

C. Rs.10,300 crore

D. Rs.10,700 crore

E. Rs.10,900 crore

- A. 3750

B. 1200

C. 650

D. 3250

E. 5700

- A. 67%

B. 75%

C. 49%

D. 79%

E. 57%

- A. Yes Bank

B. HDFC Bank

C. State Bank of India

D. ICICI Bank

E. Punjab National Bank

- A. Rs 2 lakh

B. Rs 5 lakh

C. Rs 7 lakh

D. Rs 10 lakh

E. Rs 15 lakh

1. What is the expand form of ‘OTC’?

- A. Opposite Tenure Counter

B. Over Term Counter

C. Over Transfer of Cash

D. Opposite Transfer of Cash

E. Over the Counter

- A. Forfeiting

B. Factoring

C. Exfoliation

D. Hypothecation

E. None of the above

- A. Purchase and sale of Government securities by the Government

B. Purchase and sale of Government securities by the RBI

C. Borrowing by the scheduled commercial banks from RBI

D. Lending by commercial banks to Industries and traders

E. None of the above

- A. SEBI

B. NABARD

C. RBI

D. Ministry of Finance

E. SIDBI

- A. Rs. 50

B. Rs. 100

C. Rs. 500

D. Rs. 1000

E. None of these

- A. 8.45%

B. 8.55%

C. 8.35%

D. 8.65%

E. None of these

- A. 7.2%

B. 7.1%

C. 7.3%

D. 7.5%

E. None of these

- A. Zebpay

B. Belfrics

C. BuyUcoin

D. Coinsecure

E. None of these

- A. Mangalyaan

B. Ellora caves

C. Hampi with Chariot

D. SanchiStupa

E. None of these

- A. 100 crore

B. 50 crore

C. 20 crore

D. 75 crore

E. None of these

1. Each subscriber under APY shall receive a Central Government guaranteed minimum pension of

- A. Rs. 2000 per month

B. Rs. 3000 per month

C. Rs. 4000 per month

D. Rs. 1000 per month

E. Rs. 5000 per month

- A. 64 years

B. 62 years

C. 60 years

D. 65 years

E. 80 years

- A. is used to rate the borrowers while giving advances

B. is used to work out performance of the employees

C. is used to calculate the number of excellent audit rated branches

D. is not used in any bank

E. is necessary before giving promotion to employees

- A. Venture Capital

B. Working Capital

C. Equitable Mortgage

D. Loss Assets

E. Profit and Loss Account

- A. Bond

B. Securities

C. Stock

D. Funds of Fund

E. None of the given options is true

- A. Yearly

B. Half- Yearly

C. Quarterly

D. Monthly

E. None of the above

- A. National Housing Bank

B. Unit Trust of India

C. EXIM Bank

D. NABARD

E. General Insurance Corporation (GIC)

- A. Bank of Baroda

B. Bank of India

C. Corporation Bank

D. Jammu & Kashmir Bank

E. ICICI Bank

- A. Kotak Mahindra Mutual Fund

B. Birla Sun Life Mutual Funds

C. HDFC Mutual Funds

D. IndiaBulls Mutual Funds

E. None of the above

- A. Punjab National Bank

B. Vijaya Bank

C. Dena Bank

D. Allahabad Bank

E. None of these

1. Which multilateral financial institution has recently approved $400 million loan for water supply project in state of Andhra Pradesh?

- A. Asian Development Bank

B. World Bank

C. International Monetary Fund

D. Asian Infrastructure Investment Bank

E. None of these

- A. Rs. 1500

B. Rs. 1000

C. Rs. 1200

D. Rs. 1800

E. Rs. 2400

- A. PhonePe

B. FreeCharge

C. Paytm

D. Mobikwik

E. Amazon Pay

- A. Rs. 10 crores

B. Rs. 50 crores

C. Rs. 100 crores

D. Rs. 500 crores

E. Rs. 25 crores

- A. Rs.1250 crore

B. Rs.100 crore

C. Rs.500 crore

D. Rs.750 crore

E. Rs.1000 crore

- A. Rs. 100 crores

B. Rs. 200 crores

C. Rs. 500 crores

D. Rs. 1000 crores

E. Rs. 600 crores

- A. Dewas

B. Nasik

C. Mysore

D. Raipur

E. Salboni

- A. Rs.5 lakhs

B. Rs.3 lakhs

C. Rs.7 lakhs

D. Rs.4 lakhs

E. Rs.6 lakhs

- A. Prompt Council Action

B. Prompt Corrective Agenda

C. Prompt Corrective Action

D. Private Corrective Action

E. Prompt Corrective Agency

- A. 7.1%

B. 7.2%

C. 6.8%

D. 7.4%

E. 7.3%

1. What do you understand by term ‘Venture Capital’?

- A. A short-term capital provided to industries

B. A long-term start-up capital provided to new entrepreneurs

C. Funds provided to industries at times of incurring losses

D. Funds provided for replacement and renovation of industries

E. None of these

- A. Value of Indian Currency in International Market

B. Degree of External Competitiveness of Indian Products

C. Degree of Domestic Competitiveness of Indian Products

D. Depreciation Rate of Indian Currency

E. Inflation Rate of Indian Market

- A. Direct

B. Discount

C. Dividend

D. Day Trading

E. Depository

- A. Article 282

B. Article 110

C. Article 360

D. Article 105

E. Article 112

- A. Cheap Money

B. Dear Money

C. Hot Money

D. Broad Money

E. Narrow Money

- A. Rs. 5 lakhs

B. Rs. 3 lakhs

C. Rs. 2 lakhs

D. Rs. 1 lakhs

E. Rs. 8 lakhs

- A. $100 million

B. $150 million

C. $225 million

D. $200 million

E. $250 million

- A. Rs. 28,000 crores

B. Rs. 36,000 crores

C. Rs. 82,000 crores

D. Rs. 75,000 crores

E. Rs. 68,000 crores

- A. SIDBI

B. NABARD

C. RBI

D. IRDAI

E. NITI Aayog

- A. 13.24%

B. 11.42%

C. 12.31%

D. 14.21%

E. None of these

1. The term used for an economic condition, in which there are only two large buyers for a specific product or service is___________.

- A. Duopoly

B. Duodecimo

C. Duopsony

D. Duologues

E. Duodenary

- A. 2012

B. 2011

C. 2009

D. 2010

E. 2008

- A. Asian Infrastructure Investment Bank

B. Central American Bank for Economic Integration

C. International Monetary Fund

D. International Investment Bank

E. World Bank

- A. Priority

B. Prime

C. Purchasing

D. Personal

E. Payment

- A. 10 lakhs

B. 50 lakhs

C. 1 lakh

D. 20 Thousand

E. 5 lakhs

- A. 92,247 crore

B. 96,247 crore

C. 94,247 crore

D. 97,247 crore

E. 99,747 crore

- A. 2

B. 3

C. 4

D. 5

E. 6

- A. 726

B. 826

C. 926

D. 1006

E. 786

- A. IL & FS

B. Indiabulls

C. Kisan Finance

D. Bajaj Finance

E. Capital First

- A. 80

B. 75

C. 74

D. 50

E. 51

1. The credit rating agencies (CRAs) operating in India is regulated by which of the following institutions?

- A. RBI

B. SEBI

C. IRDAI

D. NABARD

E. SIDBI

- A. Exchange Traded Funds (ETF)

B. Mutual Funds

C. Energy Funds

D. Investment Fund

E. None of these

- A. Earnings

B. Estimates

C. Exchange

D. Expansion

E. Establishment

- A. Transaction

B. Transfer

C. Taxation

D. Termination

E. Trade

- A. Actual

B. Arbitrary

C. Approved

D. Aadhaar

E. Association

- A. ESAF Small Finance Bank

B. Ujjivan Small Finance Bank

C. Jana Small Finance Bank

D. Equitas Small Finance Bank

E. AU Small Finance Bank

- A. Bharat Heavy Electrical Limited

B. Bharat Electronics Limited

C. Reliance Industries

D. Hindustan Aeronautics Limited

E. Bharat Dynamics Limited

- A. ₹ 15000

B. ₹ 20000

C. ₹ 10000

D. ₹ 30000

E. ₹ 25000

- A. ₹ 50000 Crore

B. ₹ 25000 Crore

C. ₹ 10000 Crore

D. ₹ 75000 Crore

E. ₹ 1 Lakh

- A. ₹2 crore

B. ₹1 crore

C. ₹1.5 crore

D. ₹2.5 crore

E. ₹3 crore

1. Which among the following has become the first small finance bank to introduce personal loan scheme for salaried employees?

- A. Ujjivan Small Finance Bank

B. Jana Small Finance Bank

C. Equitas Small Finance Bank

D. Fincare Small Finance Bank

E. None of the above

- A. ₹ 30000 Crore

B. ₹ 24000 Crore

C. ₹ 36000 Crore

D. ₹ 28000 Crore

E. ₹ 32000 Crore

- A. ₹ 2 Lakh

B. ₹ 5 Lakh

C. ₹ 10 Lakh

D. ₹ 3 Lakh

E. ₹ 1 Lakh

- A. 19%

B. 15%

C. 18%

D. 22%

E. 20%

- A. Nepal

B. Afghanistan

C. Uzbekistan

D. Jordan

E. Egypt

- A. Uttar Pradesh

B. Maharashtra

C. Gujarat

D. Telangana

E. Tamil Nadu

- A. France

B. Russia

C. Argentina

D. USA

E. UAE

- A. Incred

B. CCAvenue

C. PineLabs

D. Aye Finance

E. MonetaGo

- A. 400

B. 200

C. 250

D. 300

E. 100

- A. 15%

B. 10%

C. 20%

D. 25%

E. 12%

1. IFSC code is used to identify the specific branch taking part in the four primary Electronic Funds Settlement Systems in India. _________ is not a part of these four systems.

Real Time Gross Settlement (RTGS)

National Electronic Funds Transfer (NEFT)

Immediate Payment Service Systems (IMPS)

Centralized Funds Management System (CFMS)

2. Answer - Option D

Explanation -

Indian credit rating industry has evolved over a period of time.

Indian credit rating industry mainly comprises of CRISIL, ICRA, CARE, ONICRA, FITCH & SMERA. CRISIL is the largest credit rating agency in India, with a market share of greater

than 60%.

It is a full-service rating agency offering its services in manufacturing, service, financial and SME sectors.

3. Answer - Option E

Explanation -

Hot money is currency that moves regularly, and quickly, between financial markets, so investors ensure they are getting the highest short-term interest rates available.

It refers to funds that are controlled by investors who actively seek short-term returns.

Hot money continuously shifts from countries with low-interest rates to those with higher rates; these financial transfers affect the exchange rate if there is a high sum and also potentially impact a country’s balance of payments.

4. Answer - Option D

Explanation -

‘Collateralize Borrowing and Lending Obligation (CBLO)’, as the name implies facilitates in a collateralize environment, borrowing and lending of funds to market participants who are admitted as members in CBLO Segment.

CBLO is conceived and developed by ‘Clearing Corporation of India Ltd (CCIL)’.

It is hosted and maintained by Clear Corp Dealing Systems (India) Ltd, a fully owned subsidiary of CCIL.

5. Answer - Option

Explanation -

6. Answer - Option E

Explanation -

The Asian Development Bank (ADB) has bought a 14% stake in micro-financier Annapurna Finance for ₹ 137 Crore.

ADB’s investment in the Bhubaneswar-based Annapurna is an equity expansion, while a few of the existing investors raised their holding in the MFI through secondary market deals totalling ₹ 75 Crore.

7. Answer - Option D

Explanation -

In Ways and Means Advance, the interest rate on the overdrafts would be 2% more than the repo rate.

WMA is a temporary loan facility provided by the Reserve Bank of India to the central and state governments to meet their temporary mismatches in the receipts and Payments.

It has to be vacated after 90 days and the interest rate for WMA is currently charged at the repo rate.

When the WMA limit is crossed the government takes recourse to overdrafts, which are not allowed beyond 10 consecutive working days.

The interest rate on overdrafts is 2% more than the repo rate.

8. Answer - Option B

Explanation -

The International Monetary Fund (IMF) has cut India’s growth forecast for 2019-20 from 7.5% to 7.3%.

It has further projected the country to grow at 7.5% in 2020-21, supported by the continued recovery of investment & robust consumption.

9. Answer - Option B

Explanation -

The current Marginal Standing Facility Rate is 6.25%.

10. Answer - Option A

Explanation -

The National Payments Corporation of India has slashed usage fees to 10 paisa from 25 paisa for Unified Payments Interface transactions up to ₹1,000 for small transactions to

expand the system’s adoption among banks and payment service providers.

The charge for transactions above ₹1,000 has been retained at 50 paisa.

- A. Electronic Clearing System (ECS)

B. Real Time Gross Settlement (RTGS)

C. National Electronic Funds Transfer (NEFT)

D. Immediate Payment Service Systems (IMPS)

E. Centralised Funds Management System (CFMS)

- A. Banking supervisory agency

B. Small Finance Bank

C. Internet banking portal

D. Credit Rating Agency

E. Investment Fund

- A. Fire Money

B. Ice Money

C. Cold Money

D. Frozen Money

E. Hot Money

- A. NHB

B. SEBI

C. Ministry of Finance

D. CCIL

E. RBI

- A. Rs. 10

B. Rs. 50

C. Rs. 200

D. Rs. 500

E. Rs. 2000

- A. Mahindra & Mahindra Financial Services

B. Sundaram Finance

C. Manapuram Finance

D. Muthoot Finance

E. Annapurna Finance

- A. WMA is a temporary loan facility only to central government.

B. WMA has to be vacated after 30 days.

C. The interest rate on WMA would be Reverse repo rate.

D. The interest rate on the overdrafts would be 2% more than the Repo rate.

E. All the above are true

- A. 7.2%

B. 7.3%

C. 7.1%

D. 6.9%

E. 7%

- A. 6%

B. 6.25%

C. 5.75%

D. 6.5%

E. 6.75%

- A. 10 Paisa

B. 25 Paisa

C. 50 Paisa

D. 74 Paisa

E. 100 Paisa

1. The Unit Trust of India (UTI) act was formed in which year?

- A. 1948

B. 1964

C. 1952

D. 1976

E. 1986

- A. Mumbai

B. Delhi

C. Chennai

D. Kolkata

E. Pune

- A. 5 years

B. 8 years

C. 10 years

D. 15 years

E. None of these

- A. Rs 6,000

B. Rs 8,000

C. Rs 10,000

D. Rs 15,000

E. Rs 16,000

- A. Kolkata

B. Bengaluru

C. Mumbai

D. Chennai

E. Delhi

- A. SBI

B. IDBI Bank Ltd

C. ICICI Bank

D. HDFC Bank

E. PNB

- A. Allahabad Bank

B. SBI

C. Dena Bank

D. UCO Bank

E. ICICI Bank

- A. 5 lakhs

B. 9 Lakhs

C. 2 lakhs

D. 10 Lakhs

E. 25 Lakhs

- A. Airtel Payments Bank

B. Aditya Birla Idea Payments Bank

C. Jio Payments Bank

D. Fino Payments Bank

E. India Post Payments Bank

- A. 62,082

B. 65,837

C. 72,871

D. 78,279

E. 84,972

1. The amount which the shareholders will collectively get if any mutual fund is dissolved or liquidated is known as?

- A. Expense Ratio

B. Exit Amount

C. Net Asset Value

D. AUM

E. Entry Amount

- A. ASREC

B. Pegasus Assets Reconstruction Private Limited

C. Invent Assets Securitisation & Reconstruction Private Limited

D. UV Asset Reconstruction Company Limited

E. Arcil

- A. RBI

B. NSE

C. SEBI

D. PFRDA

E. IRDA

- A. IPO

B. SDR

C. IDR

D. DCA

E. All of these

- A. Floating Rate Bond

B. ZIB

C. Deep Discount Bond

D. ARD

E. RUFF

- A. Bank of Baroda

B. Canara Bank

C. HDFC Bank

D. State Bank of India

E. Axis Bank

- A. Axis Bank

B. Punjab National Bank

C. ICICI Bank

D. State Bank of India

E. Bank of India

- A. 14000

B. 20000

C. 25000

D. 28000

E. 41000

- A. 5

B. 5.5

C. 6.5

D. 6

E. 7

- A. 6.9%

B. 7.5%

C. 7.2%

D. 7.4%

E. 7.3%

1. The process by which the central bank of a country controls the supply of money in the economy by exercising its control over interest rates in order to maintain price stability and achieve high economic growth is known as:

- A. Economic Policy

B. Monetary Policy

C. Fiscal Policy

D. Credit Policy

E. Budgetary Policy

- A. EXIM Bank

B. Ministry of International Trade, GOA

C. ECGC

D. DICGC

E. None of the given options is true

- A. OIC

B. SEBI

C. CRISIL

D. TRAN

E. CERC

- A. 30[latex]^{th}[/latex] November 1915

B. 30[latex]^{th}[/latex] November 1917

C. 30[latex]^{th}[/latex] November 1923

D. 30[latex]^{th}[/latex] November 1933

E. 30[latex]^{th}[/latex] November 1919

- A. Section 25

B. Section 12

C. Section 18

D. Section 22

E. Section 47

- A. 39%

B. 49%

C. 52%

D. 65%

E. 46%

- A. ₹ 3 Lakh

B. ₹ 5 Lakh

C. ₹ 10 Lakh

D. ₹ 6 Lakh

E. ₹ 5 Lakh

- A. ₹ 5 Crore

B. ₹ 2 Crore

C. ₹ 10 Crore

D. ₹ 1 Crore

E. ₹ 6 Crore

- A. HDFC Limited

B. Life Insurance Corporation of India

C. Asian Development Bank

D. National Housing Bank

E. RBL Bank

- A. ₹ 600 Crore

B. ₹ 350 Crore

C. ₹ 500 Crore

D. ₹ 425 Crore

E. ₹ 645 Crore

1. A/An ______ is a business professional who deals with the financial impact of risk and uncertainty.

On 24[latex]^{th}[/latex] Feb 2019, GST Council reduced the tax on under construction residential properties to5 per cent from 12 per cent to boost the realty sector.

The new rates will be applicable from 1[latex]^{st}[/latex] April 2019. This decision of the GST council is expected to push demand and increase sales of under-construction properties.

The Council has also cut GST rates on affordable housing to 1 per cent from the current 8 per cent and expanded the scope of affordable housing to those costing up to Rs 45 lakh and measuring 60 sq metre in metros and 90 sq metre in non-metro cities.

3. Answer - Option C

Explanation -

Anti-dated cheque is the type of cheque on which the mentioned date is of earlier than the date on which it is presented for payment. This cheque is valid for three month from the date of issue.

Post dated cheque is the type of cheque on which the mentioned date is yet to come on which it is presented for payment.

A cheque is valid for three months. If a cheque is presented for payment after this period of three months, it is then called a ‘stale cheque’.

Bearer cheque is the type cheque, the holder person can withdraw the money i.e anyone who present can withdraw the amount.

When we draw two parallel line on corner of cheque it referred to as crossed cheque. By using a crossed cheque one can make sure that the amount specified cannot be encashed but can only be credited to payee’s bank account.

4. Answer - Option D

Explanation -

Commercial Paper- Commercial Paper (CP) is an unsecured money market instrument issued in the form of a promissory note. Corporates, primary dealers (PDs) and the All-India Financial Institutions (FIs) are eligible to issue CP.

5. Answer - Option B

Explanation -

An annuity is a plan that helps you to get a regular payment for life after making a lump sum investment. The life insurance company invests the money of the investor and pays back the returns generated from it.

6. Answer - Option B

Explanation -

IDBI Bank has launched ‘NRI-Insta Online’ account opening process for NRIs residing in Financial Action Task Force (FATF) member countries to open an account in the Bank without visiting the branch or submitting paper documents such as physical documents as well as KYC proofs. This online facility is available in IDBI Bank’s website.

7. Answer - Option D

Explanation -

Reliance Jio Digital, a subsidiary of Reliance Industries has acquired a chatbot making startup firm Haptik for Rs.700 crores.

8. Answer - Option B

Explanation -

In order to provide a boost to rural income across 13 states on India, World Bank shall provide $250 million support to the National Rural Economic Transformation Project (NRETP).

The agreement was signed between the World Bank and Government of India.

9. Answer - Option D

Explanation -

The Reserve Bank of India (RBI) and the Bank of Japan formalised the USD 75- billion swap agreement, which would act as a cushion against any sharp swings in the local currency

whenever the international financial markets turn volatile. The proposal for entering into an agreement for the bilateral swap arrangement was approved by the Union Cabinet in January 2019.

10. Answer - Option D

Explanation -

On 31[latex]^{st}[/latex] January 2019, the Central Statistical Office (CSO), Ministry of Statistics and Programme implementation has revised the GDP (Gross Domestic Product) Growth forecast to 7.2% from earlier estimate of 6.7%.The GDP growth rate at current prices also called Nominal GDP growth rate has been revised to 11.3% to 10% for 2017-18. The actual growth rate for 2016-17 has also been revised to 8.2% from the earlier estimate of 7.1% by the CSO.

- A. Actuary

B. Annuity

C. Coverage

D. Indemnity

E. None of these

- A. 10%

B. 12%

C. 9%

D. 5%

E. 7%

- A. Anti-dated cheque

B. Post-dated cheque

C. Stale Cheque

D. Bearer Cheque

E. Crossed Cheque

- A. Appropriation bill

B. Bill of Exchange

C. Certificate of Deposit

D. Commercial Paper

E. Credit Bill

- A. Actuary

B. Annuity

C. Coverage

D. Indemnity

E. None of these

- A. NRI-Rishta Online

B. NRI-Insta Online

C. NRI-VisheshSuvidha

D. NRI-DrutSuvidha

E. None of these

- A. Airtel

B. Vodafone

C. Microsoft

D. Reliance Jio

E. Infosys

- A. $150 million

B. $250 million

C. $350 Million

D. $525 million

E. $640 million

- A. Israel

B. United Arab Emirates

C. Mauritius

D. Japan

E. Singapore

- A. 7.4%

B. 7.5%

C. 6.7%

D. 7.2%

E. 7.6%

1. A Saving account or Current account is classified as ‘Inoperative’ or ‘Dormant’ if there are no transactions in the account for over a period of ___ years.

- A. 9 months

B. 1 year

C. 1.5 years

D. 2 years

E. 2.5 years

- A. Commercial Paper

B. Call Money

C. Notice Money

D. Treasury Bills

E. None of these

- A. RBI

B. NPCI

C. CCIL

D. INFINET

E. SEBI

- A. Government of India

B. Commercial Banks

C. Reserve Bank of India

D. The Securities and Exchange Board of India

E. Both A and C

- A. Cash Management Bills (CMB)

B. Bankers acceptance

C. Municipal notes

D. Federal funds

E. None of the above

- A. 8.15%

B. 9.21%

C. 8.81%

D. 9.52%

E. 7.96%

- A. 1 billion

B. 3 billion

C. 7 billion

D. 5 billion

E. 9 billion

- A. 7.2 percent

B. 7.4 percent

C. 7.0 percent

D. 7.5 percent

E. 7.6 percent

- A. Rs 60,000 crore

B. Rs 40,000 crore

C. Rs 70,000 crore

D. Rs 50,000 crore

E. Rs 55,000 crore

- A. 200 Million dollar

B. 150 Million dollar

C. 250 Million dollar

D. 300 Million dollar

E. 100 Million dollar

1.Certificate of Deposit (CD) is a _____ instrument.

- A. Short term

B. Long term

C. Negotiable money market instrument

D. Unsecured money market

E. None of these

- A. To raise funds from the public with the aim to put the investor’s wealth to productive long-term use

B. To raise the value of a country’s currency

C. To search for the best price of capital goods

D. All the above

E. None of the above

- A. Money market

B. Stock Market

C. Derivative market

D. Equity market

E. None of these

- A. Supervising the working of the stock Exchanges

B. Underwriting new Capital Issues

C. Regulating the working of depositories, custodians of securities

D. Promoting the development of a healthy Capital market

E. To protect the interests of investors in securities market

- A. Paid-up value

B. Surrender Value

C. Maturity value

D. Sum Assured

E. None of these

- A. 15%

B. 14%

C. 13%

D. 11%

E. None of these

- A. Larsen and Toubro (L&T)

B. Delhi Land & Finance Limited (DLF)

C. Tata Group

D. Jaiprakash Associates Ltd.

E. Unitech Limited

- A. 3.2%

B. 4%

C. 2.8%

D. 5%

E. 6.6%

- A. ₹ 1 Crore

B. ₹ 50 Lakh

C. ₹ 2 Crore

D. ₹ 3 Crore

E. ₹ 5 Crore

- A. 10,000

B. 15,000

C. 20,000

D. 25,000

E. 30,000

1. In Notice Money Market, the tenor of the transactions is from ________

- A. 2-7 days

B. 2-14 days

C. 2-21 days

D. 2-28 days

E. 2-90 days

2. ___________ is a voluntary market body for the bond, money and derivatives markets

- A. RBI

B. SEBI

C. IRDA

D. FIMMDA

E. UIDAI

- A. three lakh

B. four lakh

C. one lakh

D. six lakh

E. nine lakh

- A. SBI

B. RESERVE BANK

C. IDBI

D. MUDRA BANK

E. NABARD

- A. Department of Economics and affairs

B. CSO (Central Statistical Organization)

C. RBI

D. Finance ministry

E. SEBI

- A. 5.75%

B. 6.00%

C. 6.25%

D. 6.50%

E. None of these

- A. 1%

B. 1.6%

C. 1.8%

D. 2%

E. 2.8%

- A. Pune

B. Bhopal

C. Delhi

D. Lucknow

E. Kolkata

- A. Rs 3 lakh

B. Rs 6 lakh

C. Rs 7 lakh

D. Rs 9 lakh

E. Rs 4 lakh

- A. Rs. 3000

B. Rs. 1000

C. Rs. 6000

D. Rs. 1200

E. None of these

1. What is the Paid-up Share Capital of Agriculture Insurance Company of India?

- A. Rs. 200 crores

B. Rs. 500 crores

C. Rs. 750 crores

D. Rs. 100 crores

E. Rs. 600 crores

- A. T-bills offer short-term investment opportunities, generally up to one year

B. T-bills are available for a minimum amount of Rs.25,000

C. T-bills auctions are held at the SEBI headquarter

D. Both a) and b)

E. All of the above are true

- A. Formulates, implements and monitors the monetary policy.

B. Manages the Foreign Exchange Management Act (FEMA), 1999.

C. Approving rules and laws pertaining to the stock exchanges.

D. Maintains banking accounts of all scheduled ban

E. All of the above

- A. 2015

B. 2010

C. 2012

D. 2014

E. 2008

- A. Appreciation

B. Accreting

C. Accrued Interest

D. Arbitrage

E. None of the above

- A. 50000

B. 100000

C. 150000

D. 200000

E. 250000

- A. Paytm

B. Free Charge

C. Mobikwik

D. PhonePe

E. Google Pay

- A. 4.42

B. 3.11

C. 6.67

D. 1.77

E. None of the above

- A. 500

B. 1000

C. 1500

D. 2000

E. 2500

- A. 5

B. 10

C. 20

D. 25

E. 50

1.An emerging market economy is highly classified with relatively- one in which the country is becoming a developed nation and is determined through many

socio________

- A. Economic factors

B. External factors

C. Commercial factors

D. GDP factors

E. Growth factors

- A. NABARD

B. RBI

C. Public Provident Fund Authorities

D. SIDBI

E. IRDA

- A. 12

B. 11

C. 10

D. 9

E. 8

- A. A loan

B. A bond

C. A mortgage

D. A credit

E. All of these

- A. FDI

B. Interest payments received by government

C. External Commercial Borrowings

D. FII

E. NRI bank account

- A. Rs 2.98 lakh crore

B. Rs 1.50 lakh crore

C. Rs. 5.5 lakh crore

D. Rs 1.65 lakh crore

E. Rs. 3.00 lakh crore

- A. ICICI Bank

B. RBL Bank

C. South Indian Bank

D. Kotak Mahindra Bank

E. None of these

- A. 3.0%

B. 3.3%

C. 3.4%

D. 3.5%

E. 3.2%

- A. Yearly

B. Half- Yearly

C. Quarterly

D. Monthly

E. None of the above

- A. 11%

B. 12%

C. 13%

D. 14%

E. 15%

1.Which of the following is not a feature of gilt edged securities?

- A. Issued by non-governmental service organization

B. Issued by government entities

C. Repayment of both principal and interest

D. They have zero default risk

E. All of these

- A. The board of directors of the firm.

B. The stock exchange on which the stock is listed.

C. The president of the company.

D. Individuals buying and selling the s

E. Securities and Exchange Board of India

- A. Mis-selling

B. Undertaking

C. Misappropriation of funds

D. Cross-selling

E. None of these

- A. Depreciation

B. Devaluation

C. Appreciation

D. Revaluation

E. Demonetisation

- A. It is the minimum interest rate of a bank below which it cannot lend

B. It is an internal benchmark or reference rate for the bank

C. The MCLR methodology has replaced the base rate system

D. The aim of MCLR is to improve the transmission of policy rates into the lending rates of banks

E. All of the above

- A. 20 lakh rupees

B. 30 lakh rupees

C. 10 lakh rupees

D. 60 lakh rupees

E. 50 lakh rupees

- A. Uttar Pradesh

B. Uttarakhand

C. Madhya Pradesh

D. Bihar

E. Jharkhand

- A. Rs 1.9 trillion

B. Rs 50,000 crore

C. Rs 2.1 trillion

D. Rs 3.3 trillion

E. Rs 2.8 trillion

- A. Silchar in Cachar,Assam

B. Khair in Aligarh,Uttar Pradesh

C. Hirasar in Rajkot, Gujarat

D. Tezpur in Sonitpur,Assam

E. None of these

- A. Corporation Bank

B. Syndicate Bank

C. Bank of Baroda

D. IDBI Bank

E. UCO Bank

1.The Reserve Bank of India (RBI) has fined Rs 2 Crore, recently (March 2019), on which of the following bank for violating the regulatory directions regarding

SWIFT operations?

- A. Canara Bank

B. Indian Overseas Bank

C. HDFC bank

D. Union Bank of India (UBI)

E. Punjab National Bank (PNB)

- A. Rs. 25000

B. Rs. 50000

C. Rs. 1 lakh