Introduction

Introduction

- Various figures have revealed that people in India are buying more insurance policies than in the past. This increased demand has contributed to the unprecedented growth of the Indian insurance sector.

- While some buy insurance to avoid risks emerging from financial emergencies, some buy to avail the exemptions in paying high levels of income tax.

- Life Insurance Corporation of India (LIC), the biggest state-owned insurer of the country has numerous products that help in risk aversion and avail tax exemptions.

- Since the past decades, LIC is facing stiff competition from other market players. Hence, LIC has made it clear that the selection of LIC's Assistant Administrative Officer (AAO) brings them only the creamy layer.

- Besides, joining as LIC’s AAO has immense benefits in terms of income, job security, and career growth.

LIC AO

LIC AO

Before understanding the career progression, it is first essential to know the work that the LIC's AAO is entitled to.

The job of an LIC AAO is a desk job that deals with more administrative responsibility. They are not supposed to bring business to the organization, but they have many alluring tasks like:

- AAO's analyze the insurance market. With this, they can formulate new insurance schemes and products that LIC can offer their clients.

- It is equally essential for AAO's to check and analyze the existing policies. It is their responsibility to check if the information given by the policyholders is not false, misleading, or tweaked in any way.

- The Indian insurance market is filled with competitors who lure customers with new products. AAO’s shall keep a tab of products offered by the competitors.

- LIC’s AAO’s do not perform field activities, but they assist the field staff by providing them the required back-office support.

- In this competitive era, interacting with customers is crucial. AAO’s will have to resolve problems and issues of the clients through interacting.

- Customer care is essential to maintain a happy client base. AAO’s act to find errors in the policies and rectify them.

- AAO’s shall also maintain effective communication between various departments of the organization. This is essential for the seamless functioning of the corporation.

- Additionally, AAO’s will help to process insurance claims of the customers and their legal heirs thereof.

- At present, the pay scale of AAO is INR 17,240 to 32,640. The revision for the same is pending for approval of the central government. Once approved, it is expected to increase the salaries of AAO's further.

- The monthly salary of an LIC AAO is approximately INR 40,245 in metropolitan cities. This amount is inclusive of the allowances and shall differ slightly in other cities.

- However, the in hand salary that an AAO is expected to take home is around INR 33,000 per month.

- There is an annual increment in the salary of an AAO of INR 1,619 for the next fourteen years of consistent work art the organization.

- The basic pay after fourteen years will amount to INR 55,335 monthly.

- After these fourteen years, the annual increment for the next four years will be INR 1,745. Therefore, the basic pay of an AAO after 18 years working consistently as an AAO will amount to INR 62,315.

- LIC’s AAO’s are entitled to many other benefits that include pension funds, provident funds, 2 or 4 wheeler insurance, medical claims, medical benefits, and many more.

- The benefits and allowances are calculated as a percentage of the basic pay depending upon the location of the posting.

- It is now understood that the job of LIC's AAO is not an easy one. Equally challenging is to find a well-paid job like AAO.

- This does planning for such a career crucial. Planning right shall help an AAO rise as an echelon of India's premier insurance company.

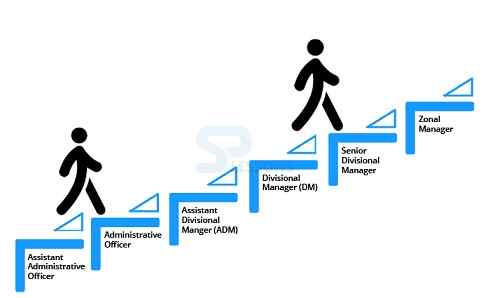

- As the senior level retirements happen annually, recruits get an excellent opportunity to move up on the ladder of promotions.

- Once the AAO has gained a certain level of experience, they are promoted as Administrative Officer.

- Internal posting helps them to move to other departments. They can avail chances and opportunities to become a Branch Manager.

- The future growth of the LIC’s AAO depends upon the promotion policies adopted by the LIC. There are various parameters set by this insurance giant. Therefore, it is difficult to approximate the exact duration for promotion.

- However, AAO promotions generally happen between five to eight years of work.

- With climbing on each promotion level, there is an increment in the salary and allowances of the employee.