[Article Source: Forbes India]

Paytm Mall is the recently formed e-commerce business of One97 Communications, which was separated from the parent to function independently around March-April 2017.

Noida-based One97 Communications operates the Paytm mobile wallet.

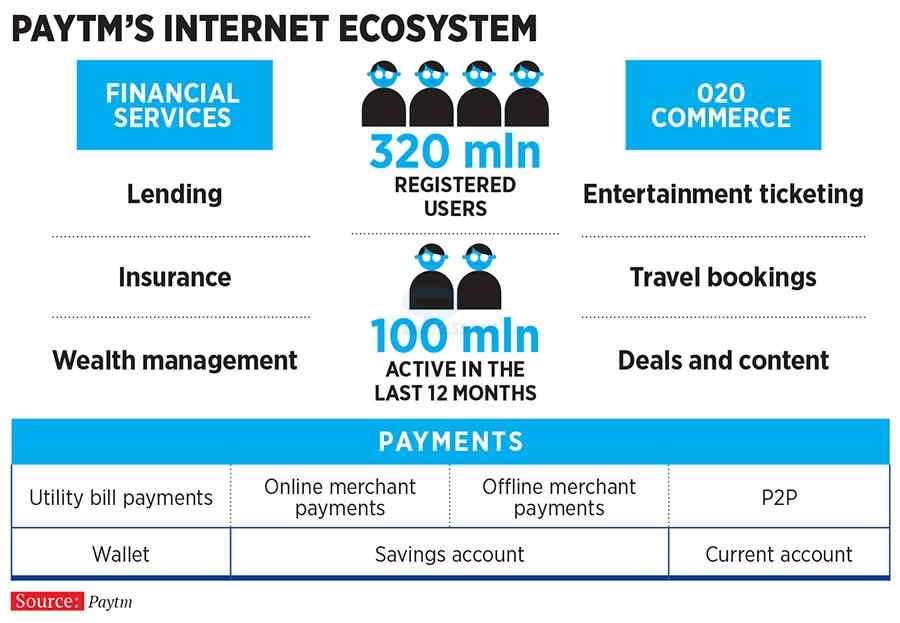

With backing from China’s Alibaba Group Holding Ltd, and Japan’s SoftBank Group Corp, founder Vijay Shekhar Sharma, 39, has been expanding into online commerce, financial services, including wealth management and insurance, as well as travel and entertainment.

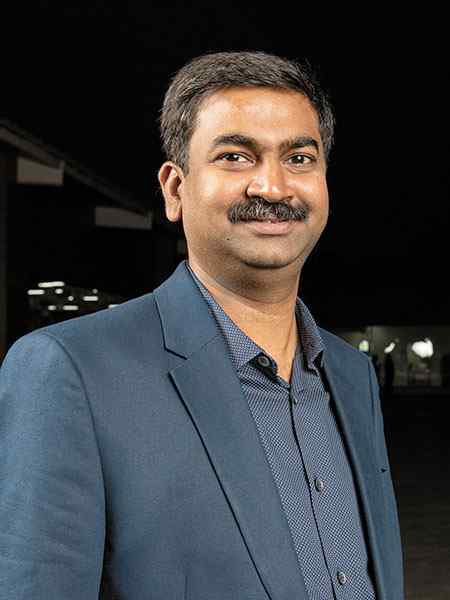

The strength of Samsung which is popular on sites such as Amazon and Flipkart, lies in its massive offline distribution. With the rise in the online smartphone sales in India, it was a challenge for the physical stores to match the offers on e-commerce sites. Amit Sinha, the vice president at Paytm and COO of its e-commerce business says: Getting onto Paytm Mall’s platform meant, be it at a physical retail store or on the online app or website, or even on Samsung’s own online storefront, “the offer is the same”.

According to Mr. Sinha, the O2O strategy has been working wonders for Paytm. O2O refers to ‘offline-to-online’ because Paytm is attempting to connect to the net via its QR codes every ‘offline’ or physical store it can reach.

Red Tape, Khadim’s shoes - the latter particularly famous in Kolkata and Lenovo laptops are among the many brands that are beginning to tap Paytm Mall to boost their sales.

The Paytm e-commerce business, which saw the formal launch of the marketplace in April 2017, doubled market share to about 14 percent by November. Helped in part by $350-million-plus sales in the 30 to 40 days through Diwali the month before.

One97 Communications restructured itself in 2017 and the mobile wallet service became part of the newly-formed Paytm Payments Bank, which in turn will lead the company’s financial services foray for consumers.

The e-commerce part of selling various products and services—from train and movie tickets to smartphones, air purifiers and washing machines became part of Paytm Ecommerce Pvt Ltd, a separate company that runs the Paytm Mall online marketplace and mobile app.

Mr. Sinha said “We are raising a large amount of money on the ecommerce side as we speak,” during the interview with Forbes India. That will make the ecommerce business alone “doubly unicorn”, and the overall company could be valued as high as $12 billion. That would top Flipkart’s value of $11.6 billion at the time of the Bengaluru rival’s $1.4 billion fund-raise in April 2017, possibly making Paytm India’s most-valued startup. Paytm Mall’s funding deal is expected to conclude soon, according to Mr.Sinha.

The funding, led by SoftBank, is to the tune of ₹3,000 crore, and Paytm Mall will likely raise more money as well.

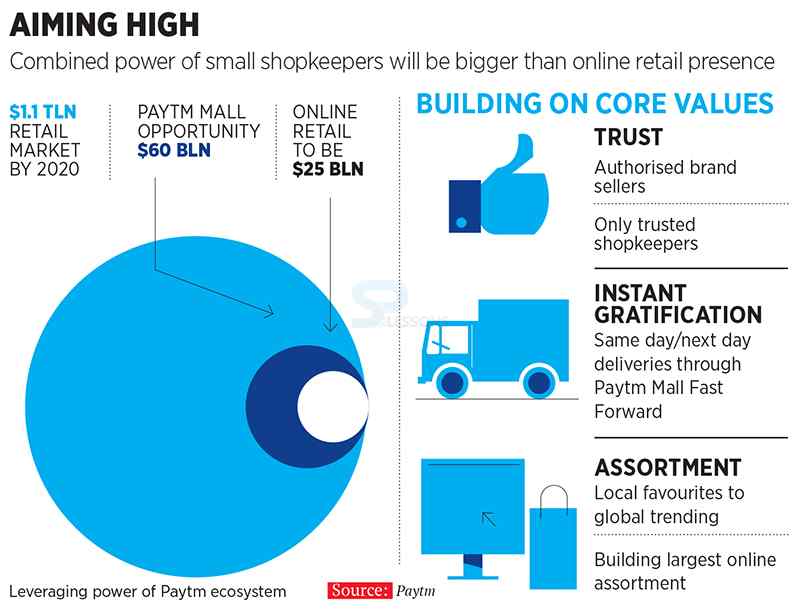

Mr. Sinha points out that India’s retail scene comprises some 15 million shops, with an overwhelming majority of those being run by individual owners and that they lack scale, and have limited inventories. Paytm plans to offer them a way of eliminating these two obstacles, so that those mom-and-pop stores could do a lot more.

Paytm is digitising India’s retail stores and training them to take orders from consumers both online and at the store. According to Mr.Sinha, with the digitization, the consumers would get “the same level of service”, that one is used to at large retailers or on e-commerce sites. It includes matching the discounts and offers. Therefore, there will be millions of points of sales and fulfillment versus a few large warehouses that the big e-commerce sites have. “That is the core belief that we are building on and early results have been really good,” Mr. Sinha says.

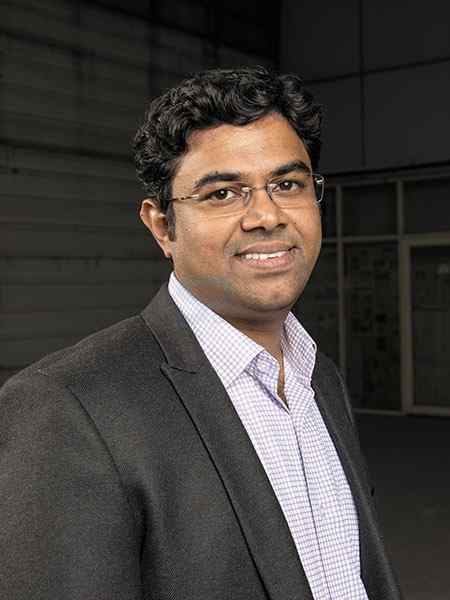

Paytm has over 300 million users and the company processes over 10 million transactions a day, says COO Kiran Vasireddy. It has 6 million merchants on its network. “The key is to reach out to every kind of small and large store to hit 10 million stores by the end of March 2019,” he says.

Loans, not just to consumers but also to sellers, form an intrinsic part of the O2O business as well. Example: When each of the 150,000 Samsung stores becomes an “endless aisle” for the consumer and the seller, Samsung gets to know what is selling where, and deeper analytics facilitate what comes next—quick and on-the-spot loans.

Of the 150,000 stores, only a few thousand have ever been able to offer a loan to a consumer to purchase a fancy smartphone. The traditional approach of banks that required a staffer to be physically present at the store and offer loans to the buyer, and hence with the traditional approach not everyone could offer loans. With Paytm Mall’s network, each store can offer the same plan from the same seller “and the campaign goes live at the click of a button”, he says. “It’s a deep and symbiotic relationship that we’re getting into with Samsung.”

“Offline merchant payments is one of the fastest growing businesses at Paytm,” says Deora. Thus, whether it’s a consumer who has a track record of honest purchases and minimal returns, or a seller who has been doing “stable” business using Paytm, they deserve to get attractive loans, is the logic.

A loan for a consumer or a loan to a seller would not be smooth the traditional banking way. On the Paytm platform, a user already has a history of transactions, and the digital platform is far more amenable to that quick loan. The story is the same when it comes to the merchant. Paytm’s solution is to partner with large NBFCs, which provide the loans, and see their portfolio expand, while Paytm brings in the tech platform. Paytm has also, in parallel, built the processes to credit-score its customers and other analytics for rapid processing.

Banking with Paytm:

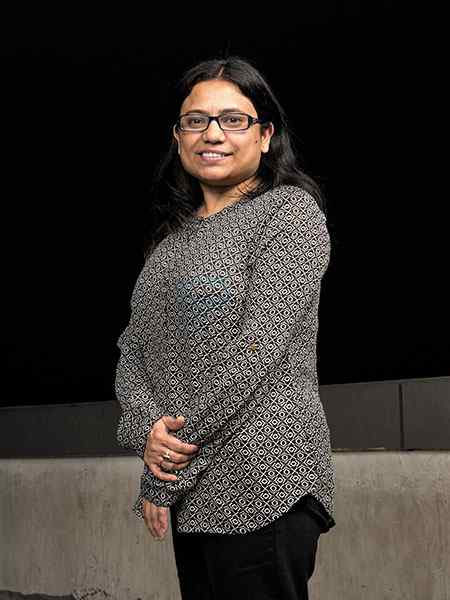

In 2017 Banking with Paytm was introduced which was an important way in which to engage the consumers right from when one receives money from any source—be it salaries or that quick ₹500 borrowed from a friend. The Paytm Payments Bank which, within ten months of going operational, has already moved to offer digital and physical debit cards to its customers. When its debit card was launched, “we got orders from 800-plus cities”, says Renu Satti, the bank’s CEO, who has worked with Sharma for over a decade at jobs that included running HR operations.

Paytm requires its savings bank account holders to maintain no minimum balance unlike traditional banks.

The bank will open 100,000 banking outlets along the same lines it is building its O2O network. Salary accounts are expected to be offered soon, as well.

An ecosystem play:

According to The Economic Times report of March 7, Paytm's financial services business will extend to lending, insurance and wealth management. Paytm Money, another independent unit like Paytm Mall, will soon start operations, selling mutual funds, The Economic Times reported on March 7, citing the unit’s head.

Mr. Sharma says, Paytm wants to be present in everything the consumer wants to do with money— “earn, save and spend”, with deposits and wealth products addressing the first, insurance the second, and the mobile wallet and Paytm Mall for the third.

Just like Amazon or Tencent, which continue to expand massive ecosystems of multiple products and services, Paytm will build its own in India—ergo everything from ecommerce to life insurance to one of Sharma’s favorite initiatives, which is O2O.

Net contribution positive:

Excluding the commerce business, which is fairly new, at the consolidated Paytm level, Mr.Sharma says “we are net contribution positive, already”,i.e. the 300 million or so transactions the company is processing every month—with the volume of transactions in the range of $1.3 billion to $1.4 billion a month—are making money “net of payments costs, marketing and cash-back costs”.

“We are making money if we take these costs into account and at the scale that we are talking about. We have only two costs left—staff and office,” Sharma says.

Mr.Sharma asserts that even with Paytm Mall, his costs are lower than those of his biggest competitors. One reason is that Paytm Mall has no warehouses of its own, “and we also have multi-party contributions”, to the cash-back and other discounts, he says.

Clever use of technology is another asset for Paytm.

In commerce, the online marketplace will overtake the retail model and that is the time Paytm would look at its options, says Mr.Sharma.

Paytm’s is a “world-first” model, Sharma says, and he aims to have Paytm in the list of names of the biggest companies in the world.

Paytm is now reloaded and is no longer just a mobile wallet as the founder Vijay Shekhar Sharma aims to make Paytm the biggest one-stop shop for all retail and financial needs. Paytm Mall and Samsung collaboration which began in November 2017 is bringing all of the Samsung phones onto Paytm marketplace, by giving each of the phones a QR code, the requisite training and support. Samsung electronics also co sells its phones through about 150,000 authorised shops in India.

Paytm Mall

Paytm Mall