Introduction

Introduction

An Interview is the test of a personality of a candidate. Interviews primarily assess the capability of a candidate to a certain profession. Interview helps to ascertain the accuracy of presented facts and information about the candidate. Presentation, Confidence and Knowledge of the applied position and industry are the crucial factors in acing Interviews.

Banking sector is pivotal to a country's economy. A Bank is a financial institution that can receive deposits and provide loans. Banks may also provide financial services such as wealth management, currency exchange and safe deposit boxes. Banking sector offers a wide variety lucrative career choices including Probationary officers, Analysts, managers, Investment Banking, Financial Planners, Credit Department, Loan Managers, etc. Career in banking demands skills in coordinating and directing the operational functions of financial institutions. Various leading private banks and public sector banks are recruiting candidates every year. Considering the significance of banking sector, several graduates are applying for various positions with the banks. Thus, the aspirants have to extremely well prepared to ace the competition. The article Banking Interview Questions Set 2 lists important Banking Job Interview Questions to assist in preparation of bank aspirants.

Questions

Questions

1. What is bank? What are the types of banks?

Answer :

A bank is a financial institution licensed as a receiver of cash deposits. There are two types of banks, commercial banks and investment banks. In most of the countries, banks are regulated by the national government or central bank.

2. What is investment banking?

Answer :

Investment banking manages portfolios of financial assets, commodity and currency, fixed income, corporate finance, corporate advisory services for mergers and acquisitions, debt and equity writing etc.

3. What is commercial bank?

Answer :

Commercial bank is owned by the group of individuals or by a member of Federal Reserve System. The commercial bank offer services to individuals, they are primarily concerned with receiving deposits and lending to business. Such bank earns money by imposing interest on the loan borrowed by the borrower. The money that is deposited by the customer will be used by the bank to give business loan, auto loan, mortgages and home repair loans.

4. What are the types of Commercial Banks?

Answer :

5. What is consumer bank?

- 1. Retail or consumer banking

- It is a small to mid-sized branch that directly deals with consumer’s transaction rather than corporate or other banks

- 2. Corporate or business banking

- Corporate banking deals with cash management, underwriting, financing and issuing of stocks and bonds.

- 3. Securities and Investment banking

- Investment banking manages portfolios of financial assets, commodity and currency, fixed income, corporate finance, corporate advisory services for mergers and acquisitions, debt and equity writing etc.

- 4. Non-traditional options

- There are many non-bank entities that offer financial services like that of the bank. The entities include credit card companies, credit card report agencies and credit card issuers

Answer :

Consumer bank is a new addition in the banking sector, such bank exist only in countries like U.S.A and Germany. This bank provides loans to their customer to buy T.V, Car, furniture etc. and give the option of easy payment through instalment.

6. What are the types of accounts in banks?

Answer :

7. What are the different ways you can operate your accounts?

- 1.Checking Account: You can access the account as the saving account but, unlike saving account, you cannot earn interest on this account. The benefit of this account is that there is no limit for withdrawal.

2. Saving Account: You can save your money in such account and also earn interest on it. The number of withdrawal is limited and need to maintain the minimum amount of balance in the account to remain active.

3. Money Market Account: This account gives benefits of both saving and checking accounts. You can withdraw the amount and yet you can earn higher interest on it. This account can be opened with a minimum balance.

4. CD (Certificate of Deposits) Account: In such account you have to deposit your money for the fixed period of time (5-7 years), and you will earn the interest on it. The rate of interest is decided by the bank, and you cannot withdraw the funds until the fixed period expires.

Answer :

You can operate your bank accounts in different ways like

8. What are the things that you have to keep in concern before opening the bank accounts?

- A. Internet banking

B. Telephone or Mobile banking

C. Branch or Over the counter service

D. ATM ( Automated Teller Machine)

Answer :

Before opening a bank account, if it is a saving account, you have to check the interest rate on the deposit and whether the interest rate remains consistent for the period. If you have the checking account, then look for how many cheques are free to use. Some banks may charge you for using paper cheques or ordering new cheque books. Also, check for different debit card option that is provided on opening an account and online banking features.

9. What is ‘Crossed Cheque’ ?

Answer :

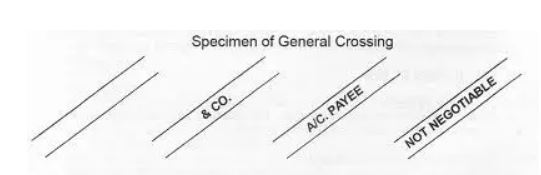

A crossed cheque indicates the amount should be deposited into the payees account and cannot be cashed by the bank over the counter. Here in the image, number#2, you can see two cross-lines on the left side corner of the cheque that indicates crossed cheque.

10. What is overdraft protection?

Answer :

Overdraft protection is a service that is provided by a bank to their customer. For instance, if you are holding two accounts, saving and credit account, in the same bank. Now if one of your accounts does not have enough cash to process the cheques, or to cover the purchases. The bank will transfer money from one account to another account, which does not have cash so to prevent check return or to clear your shopping or electricity bills.

11. Do bank charge for ‘overdraft protection’ service?

Answer :

Yes, bank will charge on ‘overdraft protection’ services but the charges will be applicable only when you start using the service.

12. What is (APR) Annual Percentage Rate?

Answer :

APR stands for Annual Percentage Rate, and it is a charge or interest that the bank imposes on their customers for using their services like loans, credit cards, mortgage loan etc. The interest rate or fees imposed is calculated annually.

13. What is ‘prime rate’?

Answer :

Basically, ‘prime rate’ is the rate of interest that is decided by nations (U.S.A) largest banks for their preferred customers, having a good credit score. Much ‘variable’ interest depends on the ‘prime rates’. For example, the ‘APR’ (Annual Percentage Rate) on a credit card is 10% plus prime rate, and if the prime rate is 3%, the current ‘APR’ on that credit card would be 13%.

14. What is ‘Fixed’ APR and ‘Variable’ APR?

Answer :

‘APR’ (Annual Percentage Rate) can be ‘Fixed’ or ‘Variable’ type. In ‘Fixed APR’, the interest rate remains same throughout the term of the loan or mortgage, while in ‘Variable APR’ the interest rate will change without notice, based on the other factors like ‘prime rate’.

15. What are the different types of banking software applications are available in the Industry?

Answer :

There are many types of banking software applications and few are listed below

16. What is the ‘cost of debt’?

- A. Internet banking system: Internet banking allows the customers and financial institution to conduct final transaction using banks or financial institute website.

B. ATM banking (Automated Teller Machine): It is an electronic banking outlet, which allows customers to complete basic transaction.

C. Core banking system: Core banking is a service provided by a networked bank branches. With this, customer can withdraw money from any branch.

D. Loan management system: The database collects all the information and keeps the track about the customers who borrows the money.

E. Credit management system: Credit management system is a system for handling credit accounts, assessing risks and determining how much credit to offer to the customer.

F. Investment management system: It is a process of managing money, including investments, banking, budgeting and taxes.

G. Stock market management system: The stock market management is a system that manages financial portfolio like securities and bonds.

H. Financial management system: Financial management system is used to govern and keep a record of its income, expense and assets and to keep the accountability of its profit.

Answer :

When any company borrows funds, from a financial institution (bank) or other resources the interest paid on that amount is known as ‘cost of debt’.

17. What is ‘balloon payment’?

Answer :

The ‘balloon payment’ is the final lump sum payment that is due. When the entire loan payment is not amortized over the life of the loan, the remaining balance is due as the final repayment to the lender. Balloon payment can occur within an adjustable rate or fixed rate mortgage.

18. What is ‘Amortization’?

Answer :

The repayment of the loan by instalment to cover principal amount with interest is known as ‘Amortization’.

19. What is negative Amortization?

Answer :

When repayment of the loan is less than the loans accumulated interest, then negative Amortization occurs. It will increase the loan amount instead of decreasing it. It is also known as ‘deferred interest’.

20. What is the difference between ‘Cheque’ and ‘Demand draft’?

Answer :

Both are used for the transfer of the amount between two accounts of same banks or different bank. ‘Cheque’ is issued by an individual who holds the account in a bank, while ‘Demand draft’ is issued by the bank on request, and will charge you for the service. Also, demand draft cannot be cancelled, while cheques can be cancelled once issued.

21. What is debt-to-Income ratio?

Answer :

The debt-to-income ratio is calculated by dividing a loan applicant’s total debt payment by his gross income.

22. What is adjustment credit?

Answer :

Adjustment credit is a short-term loan made by the Federal Reserve Bank (U.S) to the commercial bank to maintain reserve requirements and support short term lending, when they are short of cash.

23. What do you mean by ‘foreign draft’?

Answer :

Foreign draft is an alternative to foreign currency; it is generally used to send money to a foreign country. It can be purchased from the commercial banks, and they will charge according to their banks rules and norms. People opt for ‘foreign draft’ for sending money as this method of sending money is cheaper and safer. It also enables receiver to access the funds quicker than a cheque or cash transfer.

24. What is ‘Loan grading’?

Answer :

The classification of loan based on various risks and parameters like repayment risk, borrower’s credit history etc. is known as ‘loan grading’. This system places loan on one to six categories, based on the stability and risk associated with the loan.

25. What is ‘Credit-Netting’?

Answer :

A system to reduce the number of credit checks on financial transaction is known as credit-netting. Such agreement occurs normally between large banks and other financial institutions. It places all the future and current transaction into one agreement, removing the need for credit cheques on each transaction.

26. What is ‘Credit Check’?

Answer :

A credit check or a credit report is done by the bank on a basis of an individual’s financial credit. It is done in order to make sure that an individual is capable enough of meeting the financial obligation for its business or any other monetary transaction. The credit check is done keeping few aspects in concern like your liabilities, assets, income etc.

27. What is inter-bank deposit?

Answer :

Any deposit that is held by one bank for another bank is known as inter-bank deposit. The bank for which the deposit is being held is referred as the correspondent bank.

28. What is ILOC (Irrevocable Letter Of Credit)?

Answer :

It is a letter of credit or a contractual agreement between financial institute (Bank) and the party to which the letter is handed. The ILOC letter cannot be cancelled under any circumstance and, guarantees the payment to the party. It requires the bank to pay against the drafts meeting all the terms of ILOC. It is valid upto the stated period of time. For example, if a small business wanted to contract with an overseas supplier for a specified item they would come to an agreement on the terms of the sale like quality standards and pricing, and ask their respective banks to open a letter of credit for the transaction. The buyer’s bank would forward the letter of credit to the seller’s bank, where the payment terms would be finalized and the shipment would be made.

29. What is the difference between bank guarantee and letter of credit?

Answer :

There is not much difference between bank guarantee and letter of credit as they both take the liability of payment. A bank guarantee contains more risk for a bank than a letter of credit as it is protecting both parties the purchaser and seller.

30. What is cashier’s cheque?

Answer :

A cashier cheque issued by the bank on behalf of the customer and takes the guarantee for the payment. The payment is done from the bank’s own funds and signed by the cashier. The cashier cheque is issued when rapid settlement is necessary.

31. What do you mean by co-maker?

Answer :

A person who signs a note to guarantee the payment of the loan on behalf of the main loan applicant’s is known as co-maker or co-signer.

32. What is home equity loan?

Answer :

Home equity loan, also known as the second mortgage, enables you to borrow money against the value of equity in your home. For example, if the value of the home is $1, 50,000 and you have paid $50,000. The balance owed on your mortgage is $1, 00,000. The amount $50,000 is an equity, which is the difference of the actual value of the home and what you owe to the bank. Based on equity the lender will give you a loan. Usually, the applicant will get 85% of the loan on its equity, considering your income and credit score. In this case, you will get 85% of $50,000, which is $42,500.

33. What is Line of credit?

Answer :

Line of credit is an agreement or arrangement between the bank and a borrower, to provide a certain amount of loans on borrower’s demand. The borrower can withdraw the amount at any moment of time and pay the interest only on the amount withdrawn. For example, if you have $5000 line of credit, you can withdraw the full amount or any amount less than $5000 (say $2000) and only pay the interest for the amount withdrawn (in this case $2000).

34. How bank earns profit?

Answer :

The bank earns profit in various ways

35. What are payroll cards?

- A. Banking value chain

B. Accepting deposit

C. Providing funds to borrowers on interest

D. Interest spread

E. Additional charges on services like checking account maintenance, online bill payment, ATM transaction

Answer :

Payroll cards are types of smart cards issued by banks to facilitate salary payments between employer and employees. Through payroll card, employer can load salary payments onto an employee’s smart card, and employee can withdraw the salary even though he/she doesn’t have an account in the bank.

36. What is the card based payments?

Answer :

There are two types of card payments

37. What ACH stands for?

- A. Credit Card

B. Debit Card

Answer :

ACH stands for Automated Clearing House, which is an electronic transfer of funds between banks or financial institutions.

38. What is ‘Availability Float’?

Answer :

Availability Float is a time difference between deposits made, and the funds are actually available in the account. It is time to process a physical cheque into your account.

For example, you have $20,000 already in your account and a cheque of another $10,000 dollar is deposited in your account but your account will show balance of $20,000 instead of $30,000 till your $10,000 dollar cheque is cleared this processing time is known as availability float.

39. What do you mean by term ‘Loan Maturity’ and ‘Yield’?

Answer :

The date on which the principal amount of a loan becomes due and payable is known as ‘Loan Maturity’. Yield is commonly referred as the dividend, interest or return the investor receives from a security like stock or bond, interest on fix deposit etc. For example, any investment for $10,000 at interest rate of 4.25%, will give you a yield of $425.

40. What is Cost Of Funds Index (COFI)?

Answer :

COFI is an index that is used to determine interest rates or changes in the interest rates for certain types of Loans.

41. What is Convertibility Clause?

Answer :

For certain loan, there is a provision for the borrower to change the interest rate from fixed to variable and vice versa is referred as Convertibility Clause.

43. What ‘LIBOR’ stands for?

Answer :

‘LIBOR’ stands for London Inter-Bank Offered Rate. As the name suggest, it is an average interest rate offered for U.S dollar or Euro dollar deposited between groups of London banks. It is an international interest rate that follows world economic condition and used as a base rate by banks to set interest rate. LIBOR comes in 8 maturities from overnight to 12 months and in 5 different currencies. Once in a day LIBOR announces its interest rate.

44. What do you mean by term ‘Usury’?

Answer :

When a loan is charged with high interest rate illegally then it is referred as ‘Usury’. Usury rates are generally set by State Law.

45. What is Payday loan?

Answer :

A pay-day loan is generally, a small amount and a short-term loan available at high interest rate. A borrower normally writes post-dated cheques to the lender in respect to the amount they wish to borrow.

46. What do you mean by ‘cheque endorsing’?

Answer :

‘Endorsing cheque’ ensures that the cheque get deposited into your account only. It minimizes the risk of theft. Normally, in endorsing cheque, the cashier will ask you to sign at the back of the cheque. The signature should match the payee. The image over here shows the endorsed cheque.

47. What are the different types of Loans offered by banks?

Answer :

The different types of loans offered by banks are:

48. What are the different types of ‘Fixed Deposits’?

- A. Unsecured Personal Loan

B. Secured Personal Loan

C. Auto Loans

D. Mortgage Loans

E. Small business Loans

Answer :

There are two different types of ‘Fixed Deposits’

49. What are the different types of Loans offered by Commercial Banks?

- Special Term Deposits: In this type of ‘Fixed Deposits’, the earned interest on the deposit is added to the principal amount and compounded quarterly. This amount is accumulated and repaid with the principal amount on maturity of the deposit.

Ordinary Term Deposits: In this type of ‘Fixed Deposits’, the earned credit is credited to the investor’s account, once in a quarter. In some cases, interest may be credited on a monthly basis.

The earned interest on fixed deposits is non-taxable. You can also take a loan against your fixed deposit.

Answer :

50. What is ‘Bill Discount’?

- Start-Up Loans

This type of Loan is offered to borrower to start their business and can be used to build a storefront, to acquire inventory or pay franchise fees to get a business rolling.

Line of Credit

Lines of credit are another type of business loan provided by commercial banks. It is more like a security for your business; the bank allows the customer to withdraw the amount from readily available funds in an adverse time. Customer or Company can pay back over time and withdraw money again without going into the loan process.

Small Business Administration Loans

It is a Federal Agency (U.S) that gives funding to small businesses and entrepreneurs. SBA (Small Business Administration) loans are made through banks, credit unions and other lenders who partners with SBA.

Answer :

‘Bill Discount’ is a settlement of the bill, where your electricity bill or gas bill is sold to a bank for early payment at less than the face value and the bank will recover the full amount of the bill from you before bill due date. For example, electricity bill for XYZ is $1000; the electricity bill company will sell the bill to the bank for 10% to 20% discount to the face value. Here, the bank will buy the electricity bill for $900 whose face value is $1000, now the bank will recover, full amount of bill from the customer i.e $1000. If the customer fails to pay the bill, the bank will put interest on the outstanding bill and ask the customer for the payment.