Introduction

Introduction

India’s Finance Minister Nirmala Sitharaman announced the amalgamation of 10 public sector banks into four big banks on August 30, 2019. The total number of Public Sector Banks (PSB’s) in the country will now be 12 from 27 banks in 2017. The government has also announced Rs 55,250 crore upfront capital infusion in the PSBs.

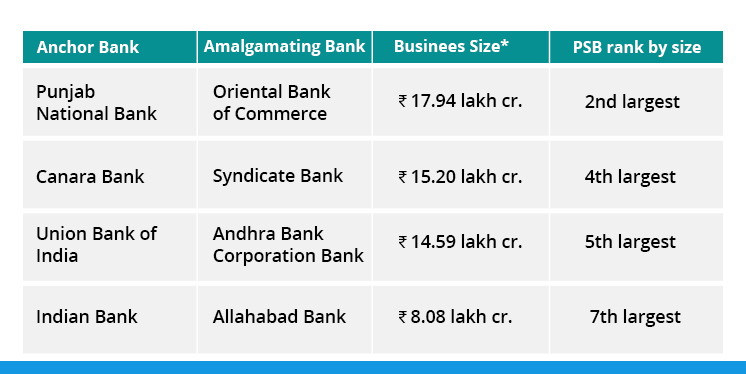

In big banks merger, Sitharaman announced that government has decided to merge Punjab National Bank, Oriental Bank of Commerce and United Bank; Canara Bank and Syndicate Banks; Union Bank of India, Andhra Bank and Corporation Bank; and Indian Bank and Allahabad bank.

Highlights

Highlights

10 Public Sector Banks to be merged into four - PSU Banks Merger India 2019

1. Indian Government to create next-generation banks with a strong national presence, & enhanced risk appetite through mergers. Public sector banks enabled to do succession planning.

2. 10 Public Sector Banks to be merged into four.

3. A number of Public Sector Banks to come down to 12 from 27.

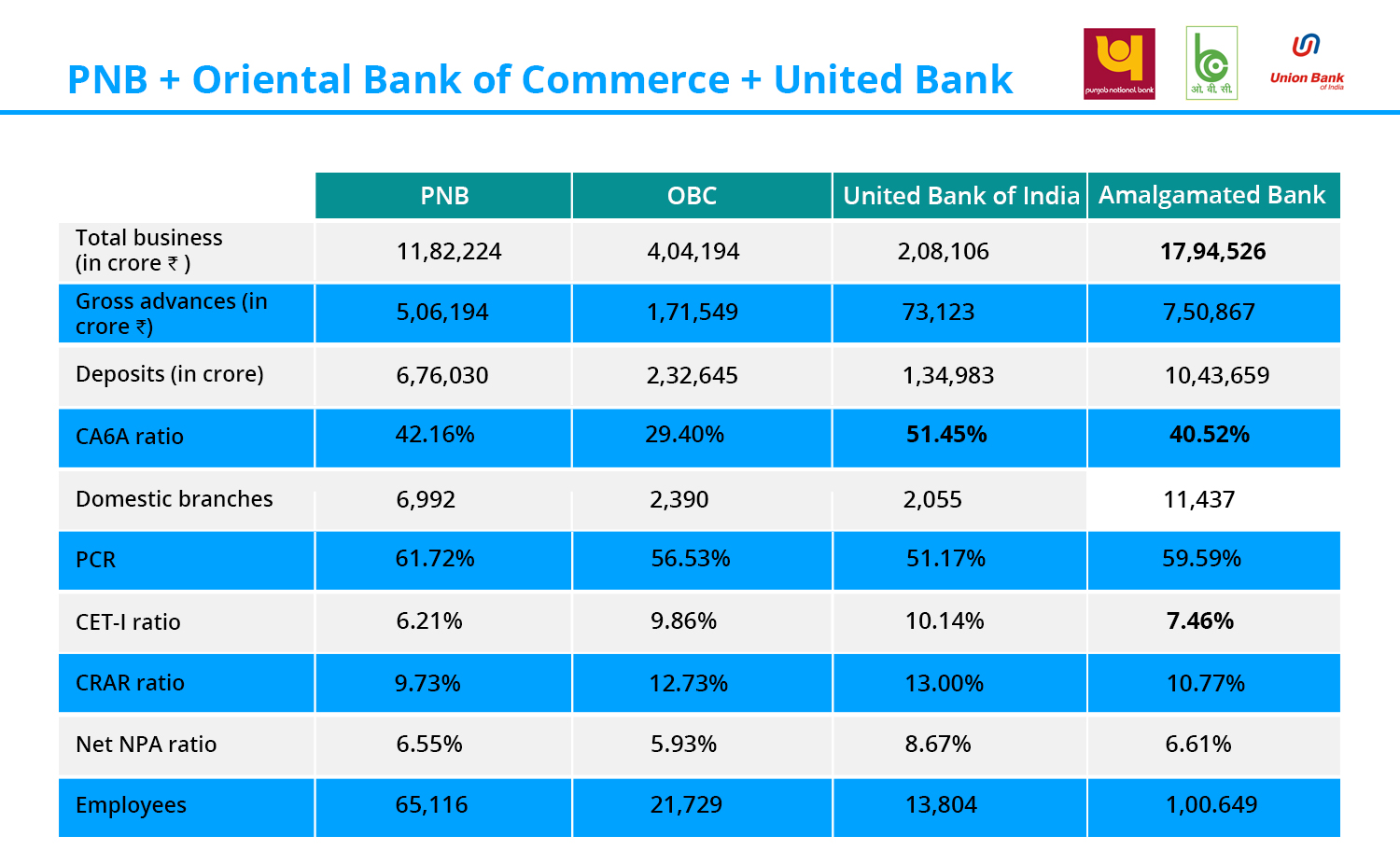

4. PNB, OBC and United Bank to be merged. The newly merged bank will be the second-largest PSB in the country with Rs 18 lakh crore business and second-largest branch network in India.

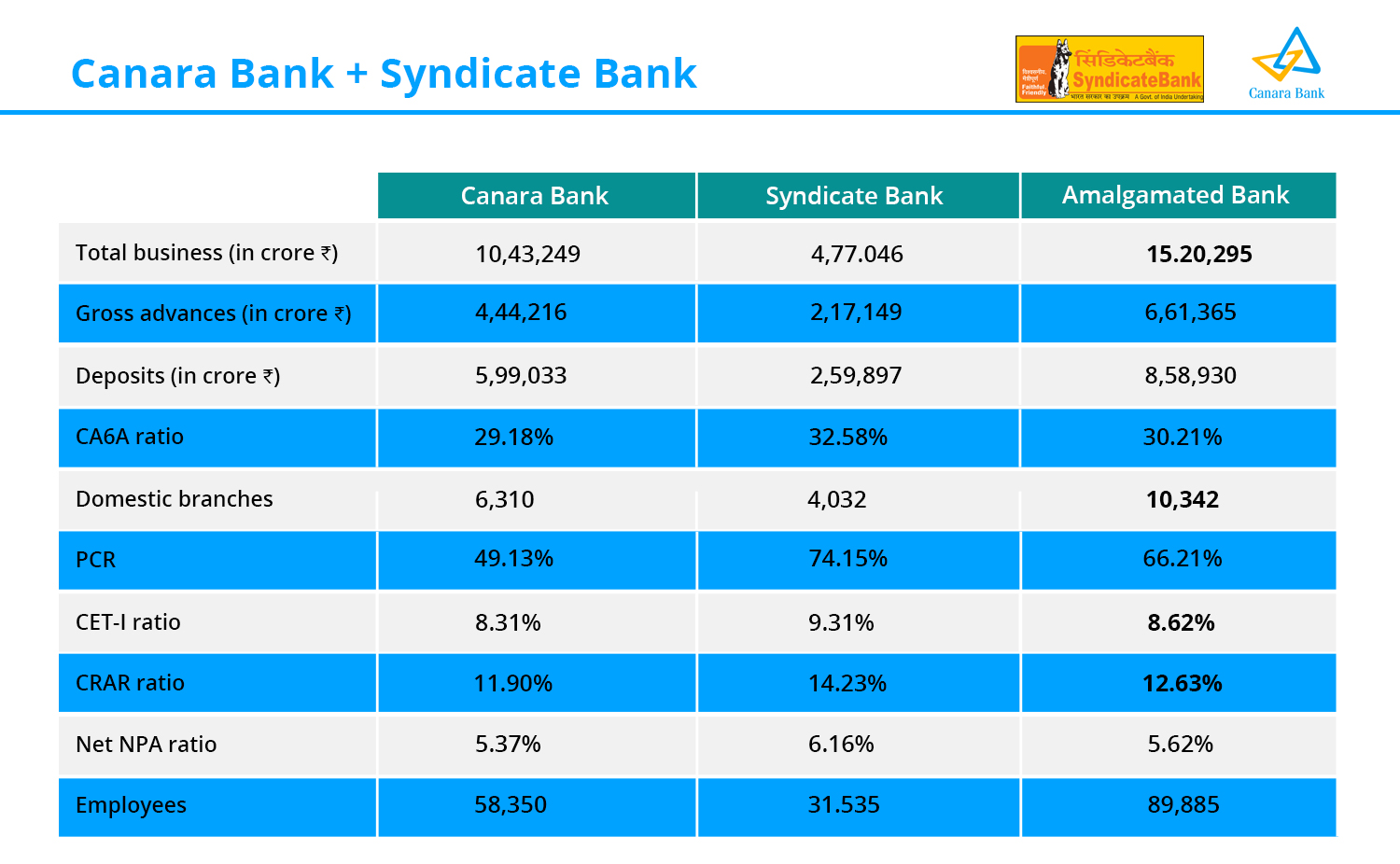

5. Canara and Syndicate Bank will also be merged to become the fourth largest PSB with Rs 15.2 lakh crore business and third largest branch network in India.

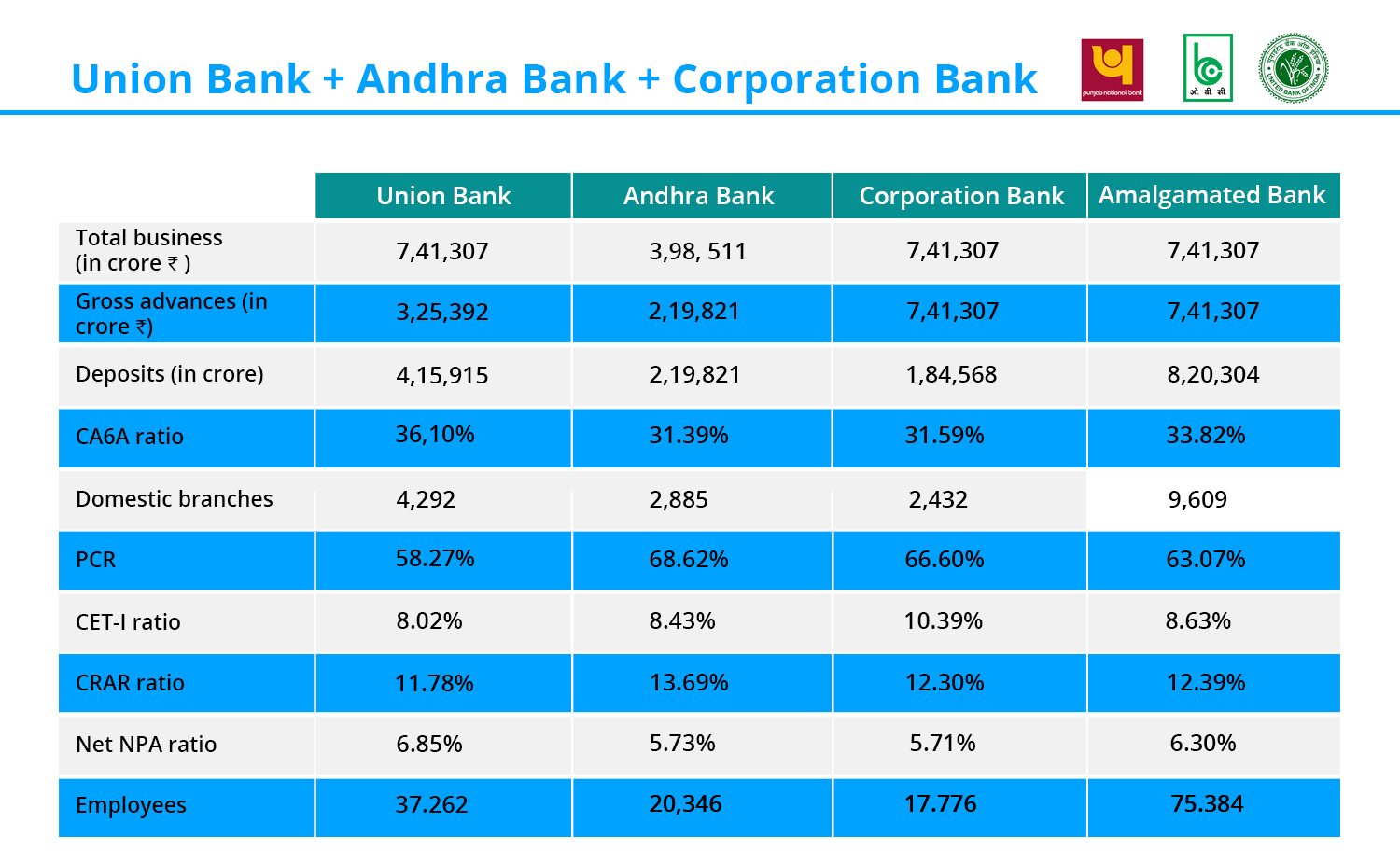

6. Union Bank of India, Andhra Bank, and Corporation Bank will be merged to create India's fifth-largest PSB with Rs 14.6 lakh crore business and fourth largest branch network.

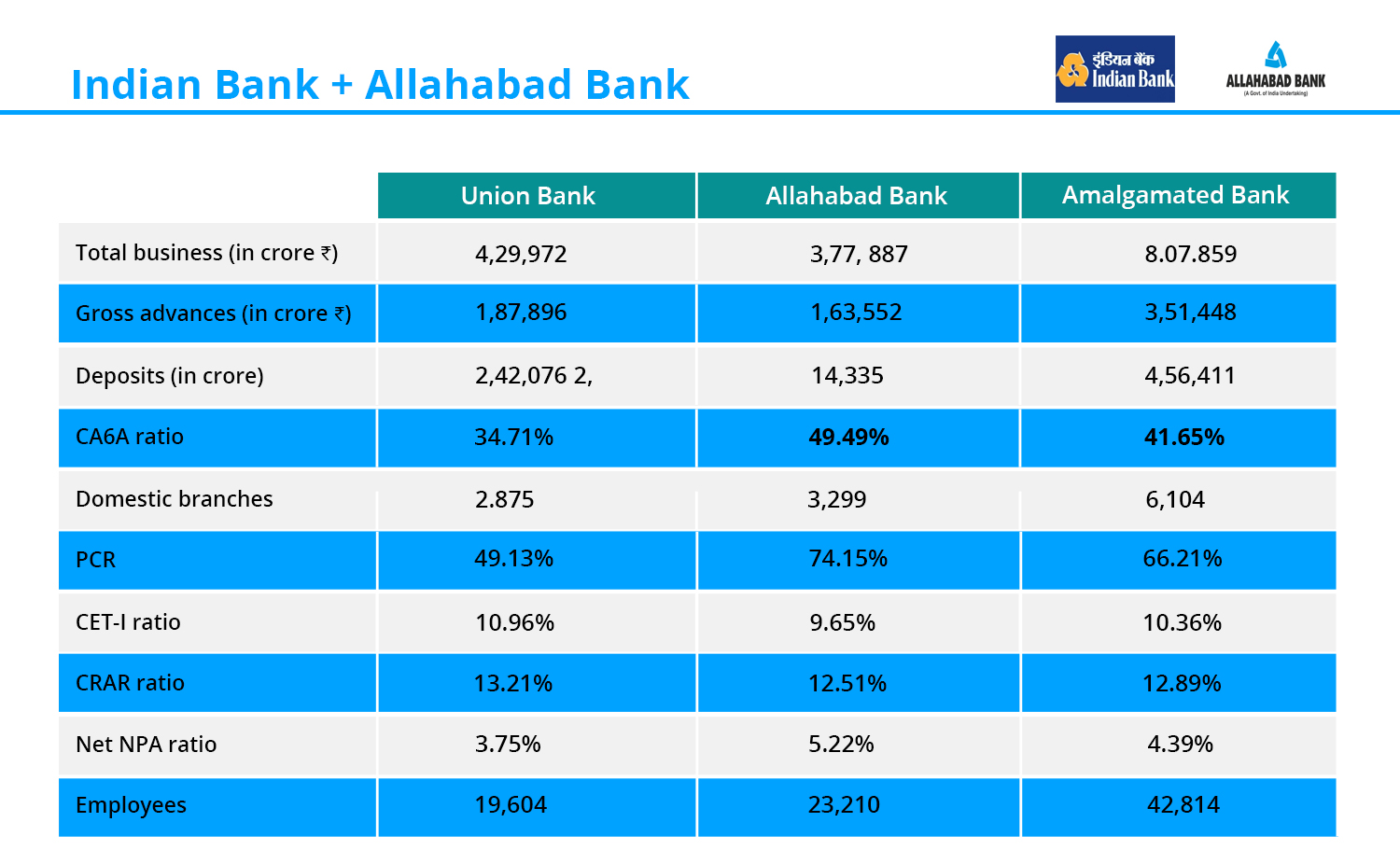

7. Indian Bank and Allahabad Bank merged. The new bank will be seventh-largest with Rs 8.08 lakh crore business.

8. Government has announced Rs 55,250 crore upfront capital for credit growth & regulatory compliance to support economy.

9. PNB will get Rs 16,000 crore; Union Bank Rs 11,700 crore; Canara Bank Rs 6,500 crore; Indian Overseas Bank Rs 3,800 crore; Central Bank of India Rs 3,300 crore; Bank of Baroda Rs 7,000 crore; Indian Bank Rs 2,500 crore and Uco Bank Rs 2,100 crore.

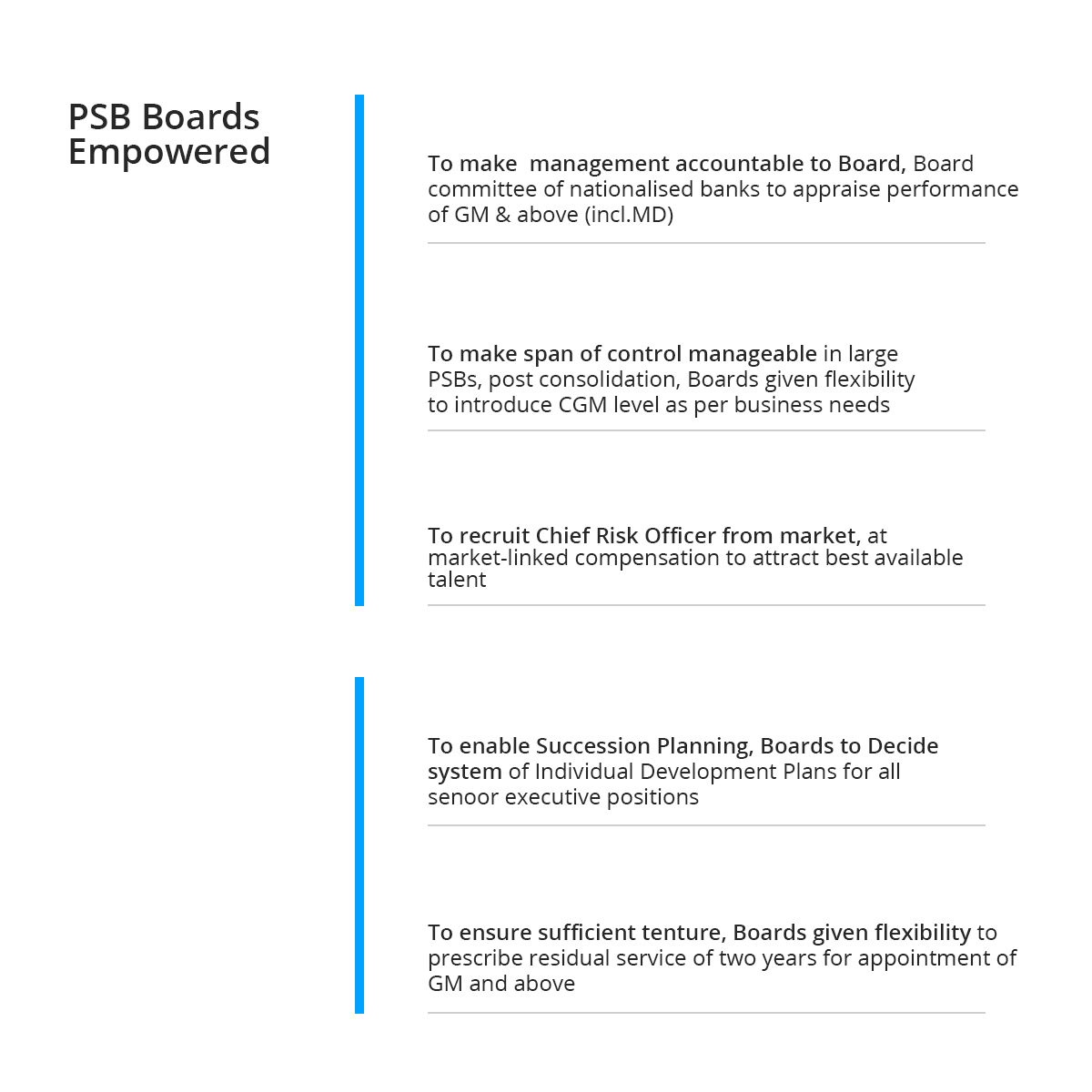

10. Big banks with enhanced capacity to increase credit and bigger risk appetite, with a national presence and global reach. PSB boards empowered.

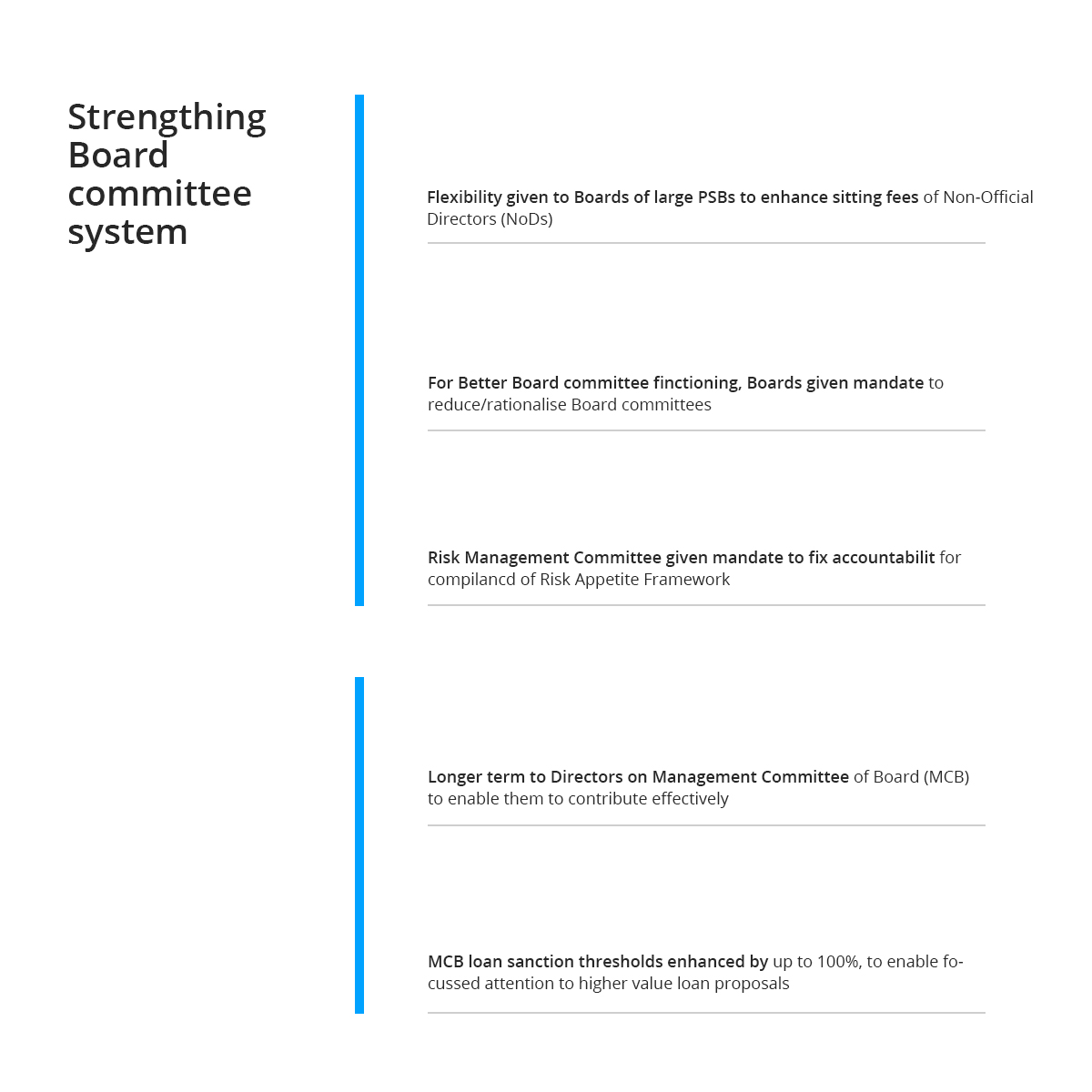

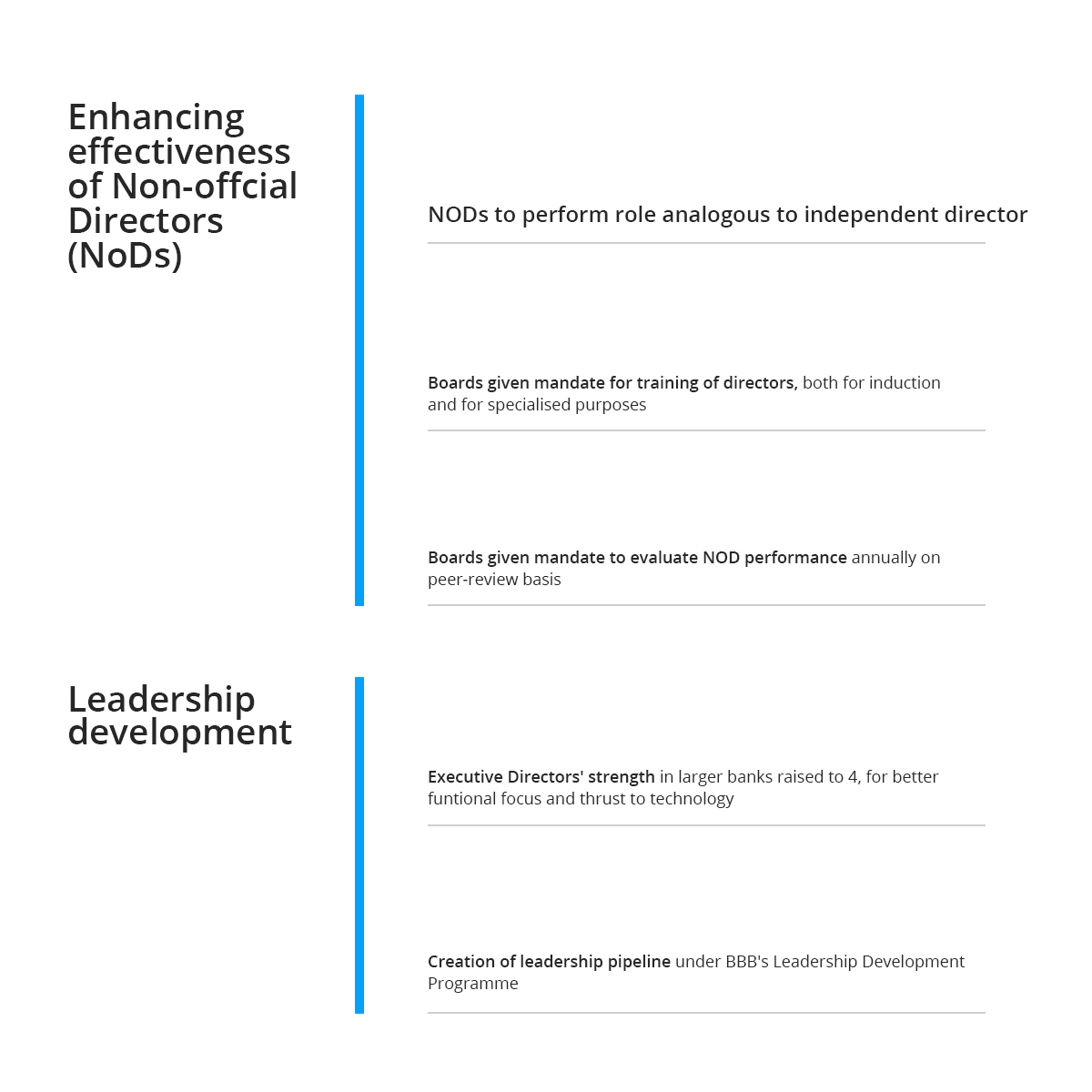

11. Bank boards have been given the flexibility to fix the sitting fee of independent directors. Non-official directors to perform role analogous to independent directors.

12. Government's intention not just to give capital but also give good governance.

13. No retrenchment has taken place post-merger of Bank of Baroda, Dena Bank, and Vijaya Bank; staff has been redeployed and best practices in each bank have been replicated in others.

14. 8 PSU banks have so far launched repo rate-linked loans.

15. Loan tracking mechanism in PSU banks is being improved for the benefit of customers

16. 4 NBFCs have found liquidity support through PSU banks since last Friday

17. For NBFCs, partial credit guarantee mechanism has already been implemented

18. Govt working on banking reforms

19. Gross NPAs of PSU banks have come down

20. Provision coverage ratio highest in 7 years

21. Best practices of each bank in the consolidation of Vijaya Bank, Bank of Baroda and Dena Bank has been absorbed

22. Non-official directors to perform role analogous to independent directors

23. Bank of India, Central Bank of India will continue as public sector banks

24. To make management accountable to the board, board committee of nationalized banks to appraise the performance of the general manager and above including managing director," Sitharaman said.

25. Post consolidation, boards will be given the flexibility to introduce chief general manager level as per business needs. They will also recruit chief risk officer at market-linked compensation to attract the best talent.

Which 12-State Run Bank will remain after merger announcement was made on August 30, 2019?

India will have 12 Stare Run Bank in comparison to 27 banks in 2017, following the announcement to manage ten banks into four.

| Name of the Bank | Logo |

|---|---|

| Punjab National Bank |

Source: Click Here |

| Canar Bank |

Source: Click Here |

| Union Bank of India |

Source: Click Here |

| Indian Bank |

Source: Click Here |

| State Bank of India |

Source: Click Here |

| Bank of Baroda |

Source: Click Here |

| Bank of India |

Source: Click Here |

| Cental Bank of India |

Source: Click Here |

| Indian Overseas Bank |

Source: Click Here |

| UCO Bank |

Source: Click Here |

| Bank of Maharashtra |

Source: Click Here |

| Punjab and Sind Bank |

Source: Click Here |

Other Articles

Study Guide

Study Guide

| Competitive Exams - Study Guide | ||

|---|---|---|

| Category | ||

| Quantitative Aptitude | Reasoning Ability | General Awareness |

| Computer Awareness | English Knowledge | Banking Awareness |

| General Science | World of Words | Descriptive Test |

Exams

Exams

| Competitive Exams - College Entrance Exams | |||

|---|---|---|---|

| Category | Notification | ||

| PG | GATE 2020 | ATMA 2019 | |

| Click Here For – All India Entrance Exam Notifications | |||

Daily CA

Daily CA

Job-Alerts

Job-Alerts

SP Quiz

SP Quiz

| Competitive Exams - Practice Sets | |

|---|---|

| Category | Quiz |

| Quant Aptitude | Permutation and Combination |

| Mensuration | |

| Reasoning Ability | Puzzles |

| Insurance Awareness | Insurance Awareness |

GK

GK

| General Knowledge for Competitive Examinations | |

|---|---|

| Topic | Name of the Article |

| GK - World | World Major Airlines |

| Important Newspapers | |

| GK - India | Vedic Literature |

| SRRM | |

| GK - Abbreviations | Science Information Technology Abbreviations |

| GK - Banking & Insurance | Banking Mobile Apps |

| Banking Codes | |

| GK - Science & Technology | Famous Websites |

| Web Portals | |