Introduction

Introduction

What is SARFAESI ACT? The Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest Act, 2002 (also known as the SARFAESI Act) is an Indian law that allows banks and other financial institution to auction residential or commercial properties (of Defaulter) to recover loans.

Best Banking Awareness Books - Disha Publications - Only @ Rs.158/-

What are Non Performing Assets? A Non-performing asset (NPA) is defined by WIKIPEDIA as a credit facility in respect of which the interest and/or installment of principal has remained 'past due' for a specified period of time. In simple terms, an asset is tagged as non performing when it ceases to generate income for the lender. In other terms, a NPA refers to a classification for loans or advances that are in default or are in arrears on scheduled payments of principal or interest. In most cases, debt is classified as nonperforming when loan payments have not been made for a period of 90 days. NPA

NPA

Non Performing Assets:

- The assets of the banks which don’t perform (that is – don’t bring any return) are called Non Performing Assets, and also bad loans.

- Bank’s assets are the loans and advances given to customers.

- If customers don’t pay either interest or part of principal or both, the loan turns into bad loan.

Asset of Bank to Non Performing Asset:

With effect from March 31, 2004, a non-performing asset (NPA) shall be a loan or an advance where:

- Interest of principal remains delay for a period of more than 90 days in respect of a term loan.

- The account remains out of order for a period of more than 90 days, in respect of an Overdraft/Cash Credit (OD/CC).

- The bill remains delay for a period of more than 90 days in the case of bills purchased and discounted.

- No activity of accounts for more than 91 days.

Out of Order Status:

- An account should be treated as out of order if the outstanding balance remains continuously in excess of the sanctioned limit/drawing power.

- In cases where the outstanding balance in the principal operating account is less than the sanctioned limit, but there are no credits continuously for six months as on the date of Balance Sheet.

Assets Classification:

- Sub-standard Assets

- Doubtful Assets

- Loss Assets

- With effect from March 31, 2005, a sub-standard asset would be one, which has remained NPA for a period less than or equal to 12 months.

- With effect from March 31, 2005, an asset would be classified as doubtful if it has remained in the sub-standard category for a period of 12 months.

- A loan classified as doubtful has all the weaknesses inherent in assets that were classified as sub-standard, with the added characteristic that the weaknesses make collection or liquidation in full, –on the basis of currently known facts, conditions and values – highly questionable and improbable.

- A loss asset is one where loss has been identified by the bank or internal or external auditors or the RBI inspection but the amount has not been written off wholly.

- Such an asset is considered un collectible and of such little value that its continuance as a bankable asset is not warranted although there may be some salvage or recovery value.

Fully Secured:

- When the amounts due to a bank (present value of principal and interest receivable as per restructured loan terms) are fully covered by the value of security, duly charged in its favour in respect of those dues, the bank's dues are considered to be fully secured.

- A restructured account is one where the bank, for economic or legal reasons relating to the borrower's financial difficulty, grants to the borrower concessions that the bank would not otherwise consider.

Sarfaesi

Sarfaesi

Sarfaesi Act Formation:

- The full form of SARFAESI Act as we know is Secularization and Reconstruction of Financial Assets and Enforcement of Security Interest”Act, 2002.

- Banks utilize this act as an effective tool for bad loans (NPA) recovery.

- to regulate secularization and reconstruction of financial assets

- enforcement of the security interest

- for matters connected there with or incidental there to

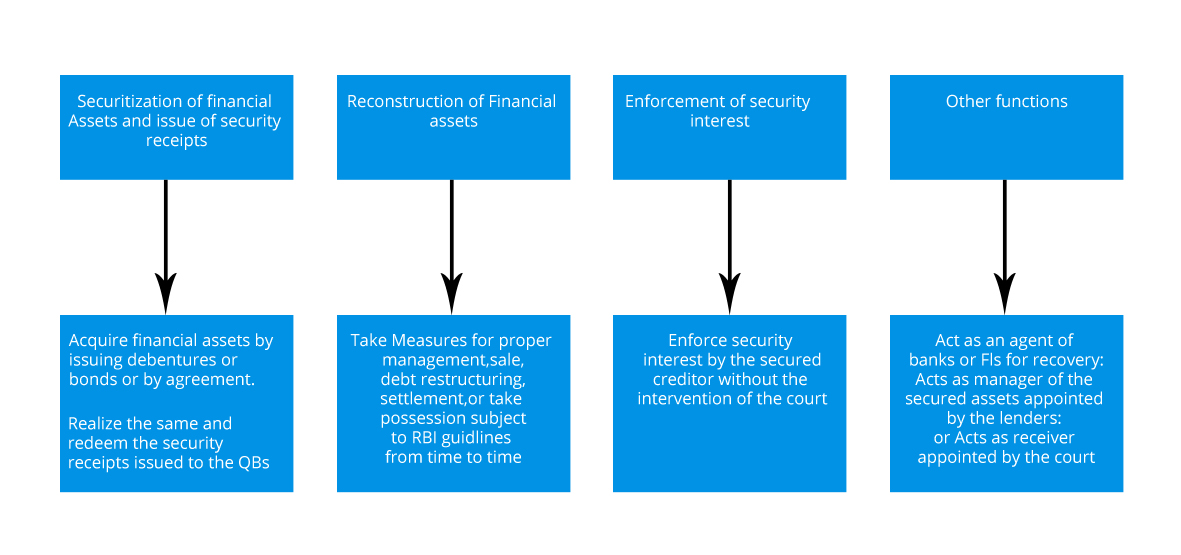

Applicability :

- Registration and regulation of Asset Reconstruction Companies (ARCs) by the Reserve Bank of India.

- Facilitating secularization of financial assets of banks and financial institutions with or without the benefit of underlying securities.

- Promotion of seamless transfer ability of financial assets by the ARC to acquire financial assets of banks and financial institutions through the issuance of debentures or bonds or any other security as a debenture.

- Entrusting the Asset Reconstruction Companies to raise funds by issue of security receipts to qualified buyers.

- Facilitating the reconstruction of financial assets which are acquired while exercising powers of enforcement of securities or change of management or other powers which are proposed to be conferred on the banks and financial institutions.

- Presentation of any secularization company or asset reconstruction company registered with the Reserve Bank of India as a public financial institution.

- Defining security interest to be any type of security including mortgage and change on immovable properties given for due repayment of any financial assistance given by any bank or financial institution.

- Classification of the borrower’s account as a non-performing asset in accordance with the directions given or under guidelines issued by the Reserve Bank of India from time to time.

- The officers authorized will exercise the rights of a secured creditor in this behalf in accordance with the rules made by the Central Government.

- An appeal against the action of any bank or financial institution to the concerned Debts Recovery Tribunal and a second appeal to the Appellate Debts Recovery Tribunal.

- The Central Government may set up or cause to be set up a Central Registry for the purpose of registration of transactions relating to secularization, asset reconstruction and creation of security interest.

- Application of the proposed legislation initially to banks and financial institutions and empowerment of the Central Government to extend the application of the proposed legislation to non-banking financial companies and other entities.

- Non-application of the proposed legislation to security interests in agricultural lands, loans less than rupees one lakh and cases where eighty percent, of the loans, is repaid by the borrower.