Introduction

Introduction

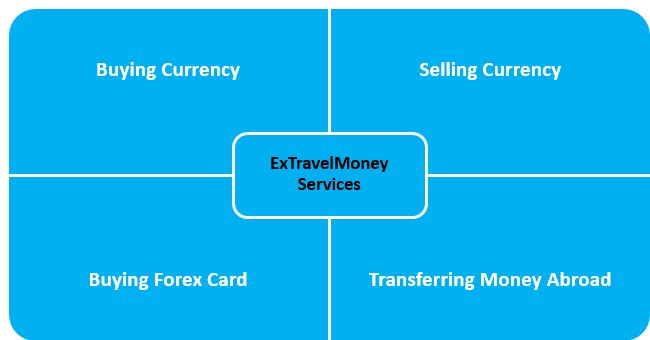

What is ExtravelMoney?

- An online platform for the exclusive purpose of Foreign Exchange.

- It was launched in 2014.

- It has, supposedly, tie-ups with more than 4000 foreign exchange outlets spread across India.

- ExTravelMoney does not charge any fee for transferring money, except the Goods and Services Tax that is applicable as per Indian Law.

ExTravelMoney

ExTravelMoney

- Indian Students studying in the US are able to wire through money from home, under RBI’s Liberalised Remittance Scheme. An online Platform like ExTravelMoney makes the process of sending Foreign Exchange hassle-free, swift, and dependable.

- Parents/Guardians can send the allowed value to their wards abroad for their University Fees, Living Expenses, etc., as and when the need be.

- ExTravelMoney makes it an easy process, and with a process completion within 48 hours is the perfect go-to service for urgent money transfers. Banks could prove to be tedious and time-consuming in such matters.

- Under LRS, Students in the USA can be sent a maximum of US$250,000 from India, ExTravelMoney helps in this transfer. It helps one to:

- Parents use the ExTravel Money window the most

-

a) Narrow down the perfect RBI-approved Authorised Dealer with the Best Exchange Rate.

b) Book the transfer transaction online.

c) Steer clear of the hassle that Banks make people go through. Example – Presenting Form 15CA/CB, and other dispensable documents which amount to Rs.3000-Rs.6000.

d) Processes are completed within 2-24 hours max.

Benefits

Benefits

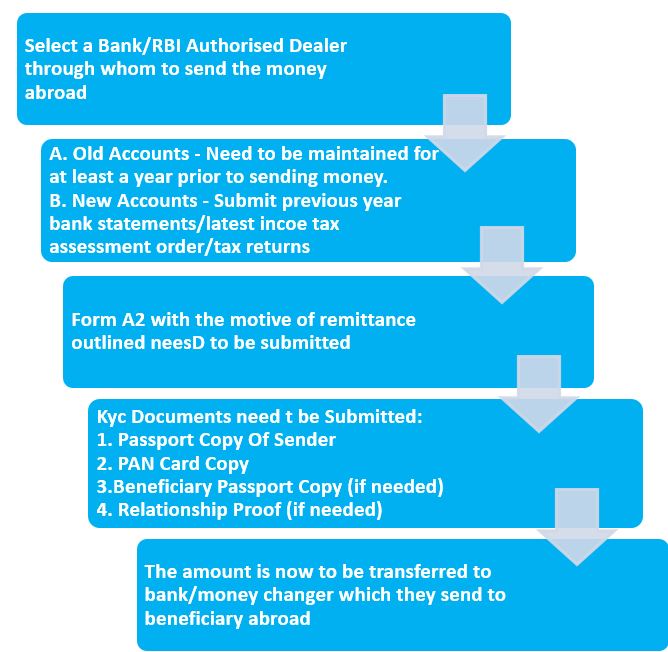

The usual method to remit money to their wards by parents/guardians of students studying abroad is as follows:

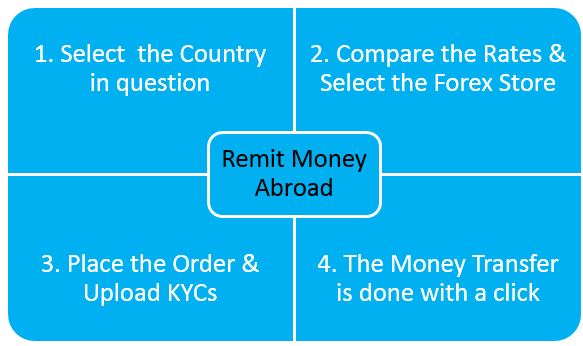

In contrast, Extravel Money lets one remit money in 4 easy steps:

1. Select the Country in Question:

- The preferred Foreign Currency is selected.

- The amount to be sent abroad is specified.

- A list of Forex Stores nearby is provided according to location selected.

- One gets to compare the quotes from the provider in order to get the best Exchange Rate.

- Service Fee and Customer Ratings of different stores can also be compared.

- The Best Forex Store is thus selected

- The order is placed.

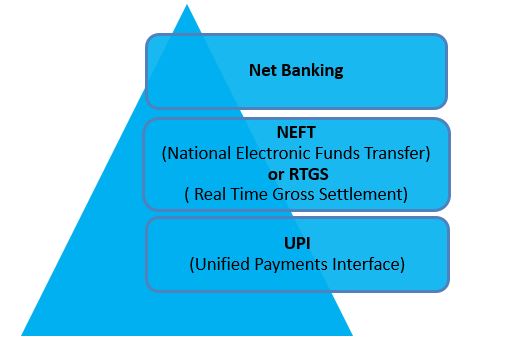

- The Forex Store is paid online through Payment Gateway or NEFT/RTGS.

- The KYC documents now need to be uploaded online through the ExTravelMoney portal.

- The payment is received by the Forex Store.

- The money is transferred to the Beneficiary Account abroad within 48 hours. If the sender completes the transaction by 2:30 IST, the money is sure to get transferred within the next 48 hours.

- Thus sending money is just a few clicks away.

With the help of ExTravelMoney, one could send money to the Following Countries:

The currencies that ExTravelMoney supports are as follows:

| Countries one can transfer to | |

|---|---|

| USA | Saudi Arabia |

| Canada | Philippines |

| Eurozone Countries | Singapore |

| Japan | UAE |

| Malaysia | UK |

| New Zealand | Australia |

| Currencies One can opt to send the amount as | |

|---|---|

| AED (UAE Dirham) | JPY (Japanese Yen) |

| AUD (Australian Dollar) | NOK (Norwegian Kroner) |

| CAD (Canadian Dollar) | NZD (New Zealand Dollar) |

| CHF (Swiss Franc) | SEK (Swedish Krona) |

| DKK (Danish Kroner) | SGD (Singapore Dollar) |

| EUR (Euro) | SAR (Saudi Riyal) |

| GBP (British Pound) | USD (US Dollar) |

One can also use ExTravelMoney’s Pick-up service for the necessary KYC documents. This is a welcome change from uploading the documents online or visit the provider to complete the formalities.

A variety of mediums to connect to an ExtravelMoney representative has been provided for:

- Chat

- Telecommunication

- ExTravelMoney Android app

Advantages

Advantages

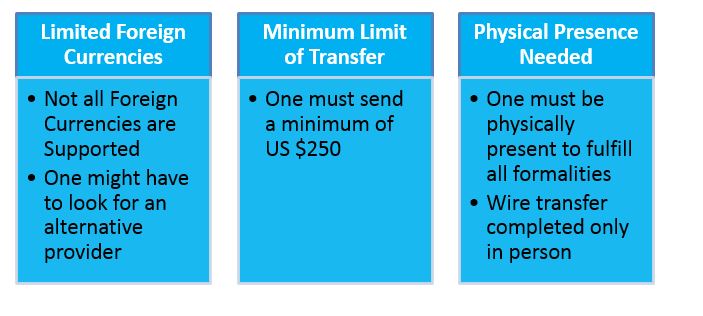

Disadvantages

Disadvantages

Conclusion

Conclusion

- It is fast.

- It is affordable

- It is convenient.

Competitive Exchange Rates and best service as the providers fight to capture clientele.

- The foreign currency or Forex Card is delivered directly to the home, saving time ExTravelMoney strives to complete transactions same day of order placement.

- There are no hidden fees.

- Traditional money changers cannot guarantee a fixed exchange rate wherEas ExTravelMoney offers the option to lock Exchange Rates for as long as 2 days.

- More than 4500 stores from across India on the platform; all of them are RBI authorized money changers.

- Forex Experts available on the portal to guide customers through the process; on the details of Forex limits, required KYC documents etc.

Note: This is surely a cost-effective solution that one ought to try out, after proper market comparison of rates.